Overview

Listen to this narration if you prefer

This chapter emphasizes the different perspectives of lenders and borrowers and how that dynamic plays into the negotiated terms of a loan. Lenders must focus on limiting their downside given their limited upside, while borrowers seek to minimize borrowing costs, restriction covenants, and associated liabilities. The chapter addresses loan interest variations, loan sizing approaches, covenants, and the refinancing decision and its risks.

Summary

The loan interest rate charged to borrowers is either fixed or floating (variable), with the latter type involving a periodic resetting of the rate based on either the current LIBOR or rates associated with shorter-term U.S. Treasuries. The term of debt is the amount of time over which principal can remain outstanding. Short-term debt is generally 3-5 years in length, and long-term debt is generally 10-30 years. Monthly interest can be calculated using a number of methodologies, with 30/360 being the most prevalent historically.

Lenders will generally underwrite a loan based on several financial ratios, including:

Loan-to-Value (LTV) – The principal amount of the loan divided by the collateral value. The ratio reflects the equity cushion the lender believes they have above the value of the loan. Typical LTVs for secured first mortgages range from 50%-70%.

Loan-to-Cost (LTC) – This ratio applies in the context of construction loans, which are based on budgeted project costs, not the value of an existing operating asset. Typical construction loan LTCs are in the range of 60%-70%.

Debt Yield – Also expressed as a percentage, this ratio is the first year’s NOI divided by the loan amount. Targeted debt yields run from 8%-13%.

Interest Coverage Ratio – The property NOI divided by the annual interest payment. The ratio indicates how many times NOI can cover the interest obligation and gives the lender an idea of how much income cushion the borrower has in terms of their ability to pay interest on the loan. Typical interest coverage ratios are 1.2x to 2.0x for secured first mortgages.

Debt Service Coverage Ratio – The property NOI divided by the annual debt service payment. This differs from the interest coverage ratio by including amortization of the loan (principal payment). Debt service coverage ratios generally exceed 1.2x for secured first mortgages.

Fixed Charges Ratio – The property NOI divided by all fixed charges incurred annually. Fixed charges include all debt service (including unsecured debt payments), ground lease payments, and operating lease payments.

While these ratios are all important, loan covenants are often far more important and contentiously negotiated. Covenants are the terms or clauses of the loan agreement. In short, positive covenants are things you must do and negative covenants are things you cannot do, as they relate to the mortgage loan.

Listen to this narration if you prefer

Common negative covenants include:

Prepayment Penalty – If the borrower pays off the loan prior to maturity, they must generally pay a predetermined penalty. The penalty is generally meant to ensure that the lender is “made whole” based on the originally agreed upon terms of the loan.

Dividends – Lenders may restrict the distributions paid to equity holders. Requiring a certain reserve amount provides a cushion for lenders during hard times.

Operating Restrictions – Lenders may make a borrower agree to a loan acceleration if certain operating performance metrics, such as minimum occupancy, are not met.

Additional Debt – Lenders may not allow you to obtain additional financing without their permission.

Common positive covenants include:

Deposits – Lenders might require you to maintain a minimum deposit balance with them.

EBIT, Cash Flow, or NOI – Lenders may require that the property maintain minimum levels of EBIT, Cash Flow, or NOI.

Leases – Lenders may require that the borrower provides copies of all new leases prior to execution.

The following is a list of critical loan terms:

Secured – Secured lenders are secured in their payment positions by recourse to the assets of the property.

Recourse – Non-recourse loans are loans that are solely secured by the property’s assets. Alternatively, lenders may additionally secure the loan against the personal assets of the borrower. This would then be considered a personal recourse loan. Most first mortgages are non-recourse, except for specially carved out “bad boy” acts by the borrower (fraud) and completion guarantees for development.

Receivables – In addition to the leases, the lender may have rights to outstanding lease payments, meaning that any monies owed by tenants to the landlord accrue to the lender in order to satisfy loan losses.

Draws – For construction loans, you must present the lender with supporting documentation on the use of loan proceeds.

Amortization Schedule – Instead of simply paying interest, most loans also have a specific amortization schedule.

Insurance –A common loan covenant is that the borrower must maintain all insurance on the property that is “customary and typical,” in an amount equal to at least the loan balance.

Sweep – Any money that comes into the property must generally be paid to the lender until contractual loan obligations are satisfied.

Loan Points – The fee that a lender will charge for processing the loan. Typically, 30 to 100 basis points of the total loan amount are due up front.

Listen to this narration if you prefer

Deciding whether to refinance early is a very difficult decision. Property owners tend to refinance to:

1) take tax-free dollars out of a property that has appreciated in value;

2) enjoy significantly lower interest rates. The most common problems associated with premature refinancing are: the time and energy involved; fees; more stringent loan terms; and prepayment penalties.

Four cases illustrate when a refinancing makes sense despite prepayment penalties:

1) you refinance with the same lender and convince them to waive or reduce the prepayment penalties;

2) you believe that interest rates are at unsustainably low levels;

3) you decide to take money off the table;

4) you can borrow at notably lower rates due to a superior credit rating or access to cheap capital.

Questions

These are the types of questions you’ll be able to answer after studying the full chapter.

1. What five key ratios that lenders consider? How do they differ? What is the most conservative ratio for a lender to apply?

2. What are some typical negative loan covenants?

3. Why would borrowers want to refinance?

4. What are the largest impediments to refinancing?

Audio Interviews

Mezzanine financing and inter-creditor agreements (7:12)

BRUCE KIRSCH: And so we also talk about mezzanine financing. And this is a category of financing that can manifest itself in a number of different ways. It could be what people know as a second mortgage. It can take the form of preferred equity, or as a hybrid of debt and equity among other forms.

The one common thread among these various manifestations of mezzanine financing is that they are all subordinate to the senior loan. And this hierarchy, or this pecking order, is formalized through an intercreditor agreement. What exactly is this inter-creditor agreement, and what does it mean to be subordinate? And what else does this agreement typically address?

PETER LINNEMAN: Well, inter-creditor agreement– it’s a legal contract that says, here is my legal right. Let’s start with the first mortgage issuer. First mortgage issuer says, I have a complete right to be paid first. I get paid monthly first. I get paid my principal first if there’s a problem, et cetera.

If you want to have other creditors involved, they have to get me to agree to change my rights. So I might say, yes, you can take on a second mortgage, but the second mortgage is not in excess of. Well, but I still get paid first, and I come first in line if there’s a bankruptcy.

And you say, well, what does the intercreditor agreement deal with in a more subtle way? In a more subtle way is what happens if the first mortgage isn’t due until the tenth of a month, and the second mortgage happens to be due the first of the month, simply by the timing of when the first mortgage was taken out– happened to be on the 10th, and the interest is due every month on the 10th.

Well, suddenly, then, I’m worried, as the first mortgage holder, that on the couple of days before my money is due, you’re sending money out to another party. And am I cool with that? And the answer is, not if it’s six minutes before me. And so, yes, even though the loan may be taken out on the first, I make them pay interest sooner and all sorts of mechanicals.

The other thing that enters into it is, yes, you can put a second mortgage on the property, but you can’t have that second mortgage transferred to any other borrower or lender without my approval. Well, in today’s world where mortgages are often sold, the person issuing the second mortgage may be very uncomfortable with that term.

Why does the first mortgage holder want it? They want to know who’s in line in front of them. They want to know the kind of people and business strategy of those in front of them. And they want to know who’s borrowing from them.

So you’re going to have issues like collateral. You’re going to have issues of timing. You’re going to have issues of transfer of ownership of the instruments. Items like that will be what will fill up.

And you say, well, it sounds like all technical, mechanical stuff. It is all technical, mechanical stuff. But it’s expensive because you’ve got to have lawyers negotiate it. You have to proof it, and it will restrict your operating behavior, especially when times are tight.

BRUCE KIRSCH: Sometimes the first mortgage holder and the mezzanine financing entities are under the same umbrella. Let’s say, Citibank is providing both the senior loan, and a different division within Citibank is providing the mezzanine financing. Is there any leniency or difference when it’s all coming from the same umbrella company? Or are these types of issues still fought out tooth and nail down to the last letter?

PETER LINNEMAN: It is easier only because it’s easier to negotiate with yourself. However, the fact that Citi, in your example, knows that it may someday want to sell, especially the first mortgage position, into the market, means they’re going to want to make sure that it has terms that can maximize the value of that.

Doesn’t mean there might not be a little more leniency in the terms, not quite as cookie cutter, because they can keep it on their balance sheet. But it does mean that there is some tendency for even if it’s done with the same party, to have tough terms in the first that you have to focus on. It’s just they are easier to get at because you’re negotiating with yourself.

I’ll give you a very good example. It’s a little advanced. But one of the things people do is when they borrow from a bank, Citi, in your example, they take technically a floating rate interest rate loan. And then Citi issues– from a different desk, Citi will issue a swap. And that swap effectively converts a floating rate loan into a fixed rate loan.

And from the borrower’s point of view you say, well, yeah, now I’ve got a fixed rate loan for 10 years, even though technically, for 10 years it’s a floating rate loan with an offsetting swap that results in a fixed rate of interest. Interestingly, both the mortgage and the swap use the real estate as collateral. Namely, if you don’t pay your floating rate mortgage, they can take your property. And if you don’t pay your swap, they can take your property as collateral. And Citi, in your example, agreed to share their mortgage collateral with the swap owner. So that was an intercreditor agreement, that they both can use that collateral.

For example, HUD, when they make loans on apartments, will not share their collateral. Namely, they say, you know, you can’t have a swap that also has a claim on the collateral. Only our mortgage can be there, come hell or high water, that’s all– that we will not agree to anything else.

So there’s a situation where negotiating with, quote, “yourself,” Citi negotiating with Citi, results in a bit more flexibility than a swap provider, say, Citi, negotiating with some straight mortgage holder who doesn’t want to compromise their collateral.

Loan guarantees and “bad boy” carve-outs (6:10)

BRUCE KIRSCH: When we talk about loans, whether they’re construction loans or acquisition loans, we’ll often discuss whether the borrower has personally guaranteed the loan, either partially or in full, and what this means is they place their personal assets at risk as a backup collateral. What does it mean to only partially guarantee a loan, and whether it’s partially or in full, does a personal guarantee for an amount that’s greater than the borrower’s net worth have any significance to the lender for amounts beyond their net worth?

PETER LINNEMAN: Well, good question. Let’s say, what is a partial recourse to the borrower? A partial recourse is a situation, where I may have a $50 million loan, and the property is collateral. In addition, as the borrower I’m responsible for up to $2 million of that $50 billion loan personally against my personal assets, my personal income, et cetera.

So it’s not a full guarantee of the loan, but it is guaranteeing that, if a $50 million loan comes due and the property doesn’t generate the full $50 million, the first $2 million shortfall I make up. Now, if the shortfall is $5 million, I would make up $2 million of it personally, and then the lender suffers the remaining loss. So that’s a partial recourse.

There also recourses that exist conditionally. The most common are construction guarantees, where I provide full recourse personally for the debt beyond the property up until a certificate of occupancy or some degree of leasing or completion of construction occurs. You almost always have in loan documents, so-called bad boy carve outs, that say, if I defraud you, if I violate laws, if I do bad things, hence, the bad boy carve-out.

For those things, there’s personal recourse. For everything else, if the market goes bad and I just can’t pay you, the building is not generating enough income and I can’t pay you, as long as I didn’t do any bad behavior, there’s no personal recourse under a bad boy. It’s only if there’s some type of bad behavior as defined by the document. So you can have partial.

Why does the lender want it? The lender wants it, because if the asset isn’t enough to cover their loan, they want to have personal assets. Borrowers clearly don’t want personal recourse, saying, look, you’ve got a hard asset here. You’ve had the chance to underwrite it. You’re giving us a loan that has sufficient interest coverage and a loan that has sufficient loan-to-value coverage that you shouldn’t get personal recourse.

Do lenders value it? It’s funny. Lenders absolutely value the idea of it, but one of the things lenders find out is in a bad market, somebody who looks like they have a lot of wealth may not. Namely, imagine somebody who on five properties has $10 million equity value in excess of a 90% loan. So there’s a person who looks like they have a lot of wealth, but a 10% drop in property market values in general wipes it all out, and therefore the personal guarantee is not worth anything.

Lenders like it because it puts a burden. People undoubtedly think more about a personal guarantee than a property only guarantees, and lenders like it, even if it is more than what you think their personal wealth is, because who knows what happens between now and then, and it definitely makes you think.

BRUCE KIRSCH: On that note, isn’t this potential liability on a personal level, one of the reasons why a lot of real estate investors and developers will put their assets in their spouses name?

PETER LINNEMAN: Sure. There’s a whole bunch of mechanical ways to shelter in that regard under US law and depends on the country you’re in the state of the United States you’re in, but yes, it is absolutely. And in fact, there have been examples, where in some cases, I may only have net wealth of $1 million, and I’ve got personal guarantees, but my father or my aunt or someone might have substantial personal wealth, and if they die, that asset value that comes in through my inheritance is part of my guarantee if and as I inherit it.

And there have been some tricky times where people in bad markets have been negotiating to get rid of their loan saying, well, I have no wealth, and then a parent dies and suddenly, they could be quite wealthy and the negotiations get very tricky.

BRUCE KIRSCH: In one sense, a good problem to have.

PETER LINNEMAN: You can imagine for somebody has– you could have a $100 million inheritance coming in, and you say, boy, I’m going to be rich, rich, rich forever, and you’ve got $80 or $90 million of personal guarantees sticking out on a real estate development that you were minutes away from having settled and being free of. And you go, holy cow, my entire inheritance is now going to just go to pay off this lender that was hours away from settling that they have no claim, and you can get quite crazy.

Re-financing as a business strategy (4:56)

BRUCE KIRSCH: When we talk about refinancing this is when we take the existing loan on a property and we replace it with a new loan. And this is often the crux of somebody’s investment strategy where the basic thought is that if the property as it is cash flowing today can support a 60% loan to value and then over some interim period of years– let’s say three years, five years– that property value rises.

We can go out at that point in the future and then get a new 60% loan to value. And on that larger value that 60% will more than outstrip what you still owed on the original 60% loan to value. And so at that point you can access tax deferred capital with which you can make other investments or do whatever you wish.

But the fundamental flaw in this whole strategy is you think that property values will undoubtedly rise. And so this is one of the things that obviously a lot of people got caught without a chair when the music stopped in 2008 and 2009. Because they were basing their whole investment strategy on this big trend that, my property value was just going to continue to go up.

And that is essentially, my savior is the refinance. So how do we guard against being optimistic in a sense, when we know that as an investor you have to be somewhat optimistic?

DR. PETER LINNEMAN: Yeah, it’s a perfect point. Because over a long term values do go up even if it’s just general inflation. I mean think about replacement costs go up because of general inflation. That means that building values tend to go up because of general inflation. And over any long period values tend to go up.

There’s a big gap between tend and have at the moment I need to refinance. And therefore the thing you need to do is, yes, your business plan is for values to generally go up and I’ll refinance. I’ll take a little money out. I’ll use the rest to refinance the existing loan, and keep moving forward merrily.

That’s a great business plan. You need to allow yourself the flexibility that the plan goes wrong. That’s just Business 101. You cannot have a business plan that only allows success if everything goes perfectly.

You have to allow as a general matter business plans that, they work best when everything goes as planned, but they work adequate when they don’t work perfectly.

And the way to do that is to leave a cushion– cushion in terms of loan to value. Don’t push your loan to value to its maximum. Give yourself a cushion. Cushion in the sense of have plenty of income available in case your income gets hit, that you can continue to pay interest and principal.

If you’re a real estate company stagger your loans so they all don’t come due at the same time. That generally means taking longer term debt and staggering– say, always take out 10 year loans and have 1/10 of it due every year. Because the odds are not that everything will be coming due then when no one wants to lend. It’s taking those kind of strategies.

On the operating side if you’re highly leveraged you better be gravitating to very high credit tenants with longer term leases where there’s not as much tenant improvement work as you need.

Another dimension is borrowing long term versus short term. If I’m borrowing short term I constantly am counting on when my loan comes due the market will want to refinance it.

Whereas if I borrow longer– imagine I go get a 35 or 40 year loan on an apartment project with a HUD loan. It basically means I’ll never have to renegotiate this loan. I’ll be dead by the time this loan gets renegotiated. I locked in my spread in the meantime between the interest rate and the yield.

So none of those are perfect, but you have to allow yourself room to survive over the long term as if your business plan is leverage and refinance. One of the other things is to have a strong balance sheet. Namely, have equity available if you need the equity because they won’t fully roll over the loan. All these are just common sense but they’re really part of the business strategy.

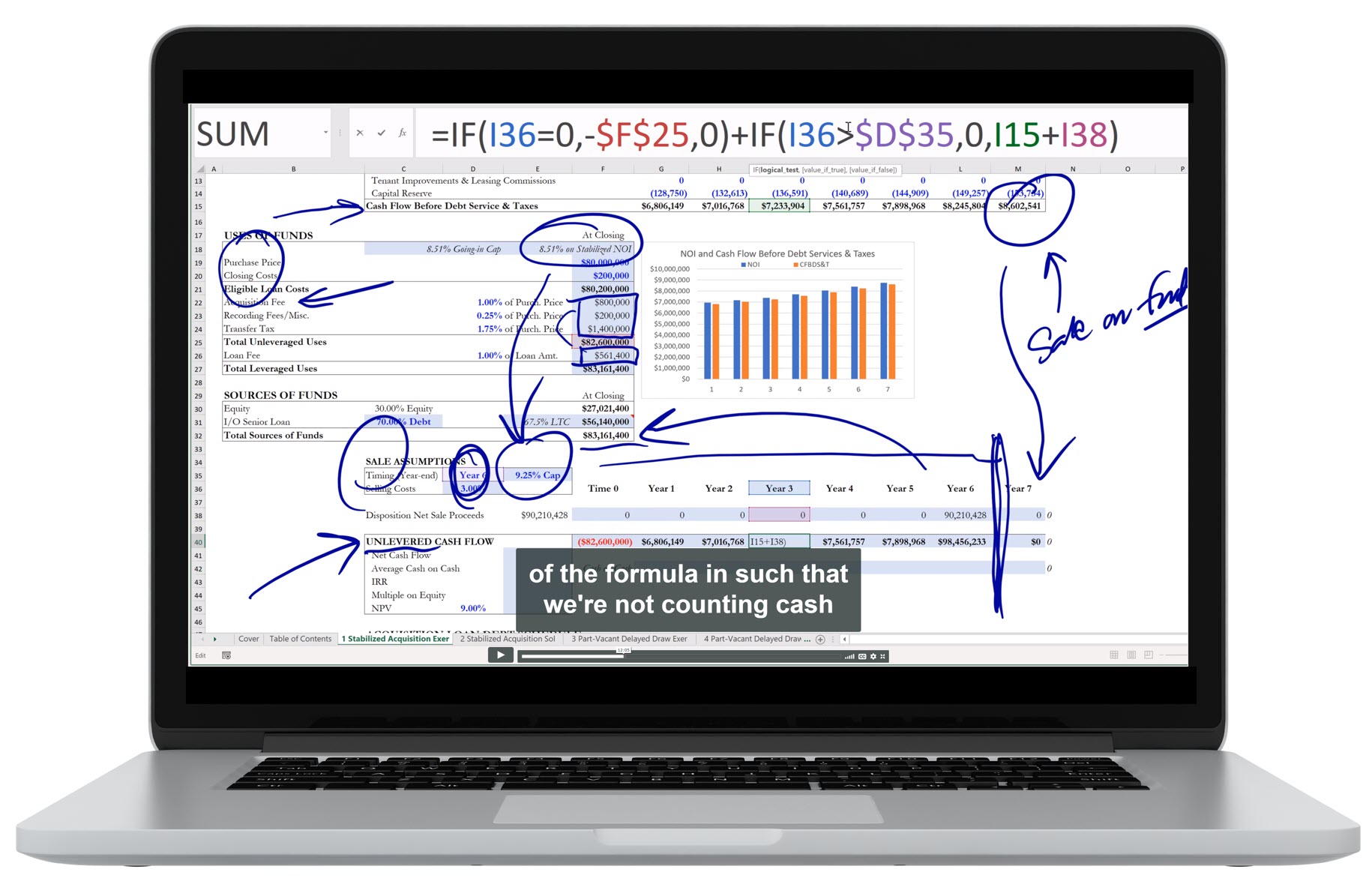

Excel Figures

Key Terms

To view the definition, click or press on the term. Repeat to hide the definition.

A nominal rate that stays constant for the duration of the loan term.

Adjusts with the debt markets; the rate the borrower pays is reset at a negotiated time interval.

A ceiling on how high a variable interest rate can rise.

A limit on how low the interest rate charged on the loan can be.

The amount of time over which loan principal can remain outstanding.

The most prevalent loan interest calculation method, which takes the nominal interest rate and divides it by 360 days to get the daily equivalent rate, then multiples this daily rate by 30 to get the monthly rate.

A loan interest calculation basis in which the monthly rate is calculated by taking the annual interest rate, dividing it by 365 days and then multiplying that daily rate by the number of days in the current month.

A loan interest calculation method in which the annual rate is divided by 360 days (not 365) and then multiplied by either 365 or 366; this is the most expensive basis of calculation for the borrower.

The analytical process that a lender uses to assess the risk of a potential loan.

The principal amount of the loan divided by the estimated property value; the LTV % reflects how much equity cushion the lender believes they have before the loan is “underwater” (the property value falls below the outstanding loan amount).

A valuation method for properties based on comparable sales or income capitalization.

The amount of construction loan principal as a percentage of total eligible development costs.

With respect to a construction loan, these are the costs for property development elements that have collateral value to the lender, and, thus, liquidation value in the event of a foreclosure. Eligible loan costs include land, hard costs and non-financing-related soft costs.

A loan sizing ratio that is calculated as the first year’s NOI divided by the loan amount. The debt yield can be thought of as the “lender’s cap rate.”

A loan-sizing ratio that divides the property NOI by the annual interest payment. Indicates how many times NOI can cover the interest obligation and gives the lender an idea of how much of an income cushion the borrower has in terms of their ability to pay the interest on the loan.

A loan sizing ratio that divides the annual NOI by the annual debt service payment inclusive of both principal and interest.

A loan sizing ratio that divides the property annual NOI by all fixed charges incurred annually. Fixed charges include: all debt service payments and other fixed amounts the borrower incurs, including ground lease and operating lease payments and payments on unsecured debt.

Terms or clauses of loan agreements.

Under a loan contract, these are the things the borrower cannot do.

Under a loan contract, these are the things the borrower must do.

The act of the lender demanding full principal repayment prior to loan maturity.

A cash penalty levied if mortgage principal is prematurely paid down or paid off in full.

The complete prohibition of early loan principal repayment for a specified period of time.

A loan secured by recourse to the assets of the property; if the borrower fails to repay the loan, the secured lender is entitled to foreclose on the collateral to satisfy their claim.

A loan solely secured by the property’s assets; the lender only has recourse to the property’s assets and cannot seize any of the borrower’s personal assets to recoup any principal not repaid.

If the loan is non-recourse, if the property value falls below the loan balance, the borrower can, de facto, sell the property to the lender for forgiveness of the loan balance. In this way the outstanding balance is essentially a put option for the borrower.

The lender secures the loan against both the property as well as the personal assets of the borrower. If the borrower does not repay the loan, the lender can look to possess and liquidate the borrower’s personal assets to cover any losses on their own, with the specifics of the process covered by state and federal bankruptcy codes.

Within a loan contract, a formal pledge by the borrower promising certain events will occur, such as construction completion and leasing up a new development to a certain level of occupancy.

A periodic request from a construction loan borrower that the lender advance funds, based on project costs incurred for which the borrower has been invoiced or for which they have already paid.

A request from a construction contractor or service provider for payment for work put in place or services rendered.

Written statement by a landlord to a tenant defining the scope of their space’s interior construction.

A loan’s constant payment factor relative to the loan amount, given a known interest rate and term of amortization.

A repayment of the outstanding principal sum made at the end of a loan period.

A loan clause that allows the lender to take all cash inflows until the borrower’s loan obligations are satisfied.

The schedule over which loan principal is repaid.

A fee the lender charges for processing the loan.

The replacement of one debt facility with another.

What remains available as cash to a borrower when they repay an in-place loan with a loan larger than the outstanding balance of the in-place loan.

A type of loan prepayment penalty that involves a substitution of the collateral: Treasury bonds for the real estate. It requires that the borrower purchases a portfolio of U.S. Treasuries sufficient to make all of the remaining scheduled loan payments.

A loan prepayment penalty in which the lender is made whole on the unpaid interest that they would have received if the borrower had not prepaid.

Chapter Headings

- Interest Types and Short-Term Versus Long-Term Debt

- Interest Calculation Bases

- Key Loan Sizing Ratios

- Loan-to-Value and Loan-to-Cost

- Debt Yield

- Interest Coverage Ratio

- Debt Service Coverage Ratio

- Fixed Charges Ratio

- Other Key Loan Terms

- Common Negative Covenants

- Prepayment Penalty

- Distributions

- Operating Restrictions

- Additional Debt

- Common Positive Covenants

- Deposits

- EBIT, Cash Flow, or NOI

- Leases

- Loan Terms

- Secured

- Recourse

- Guarantees

- Receivables

- Draws

- Amortization

- Insurance

- Sweep

- Loan Points

- The Refi Decision

- Repayment Penalties

- Refinancing in a Down Market

Learn about REFAI Certification

< Ch 14 | Should You Borrow?

Ch 16 | Sources of Long- and Short-Term Debt >

Table of Contents

Index

Buy the Book