Overview

Listen to this narration if you prefer

A pro forma for development projects is comprised of two phases: the planning and construction phase, and the operating phase.

Summary

The first phase includes all costs incurred during planning and construction, including hard and soft costs. Hard costs tend to flow over the life of a project like an S curve: at first when the land is being cleared, construction costs are relatively low, but as more labor and capital-intensive work takes place, costs begin to soar. As the finishing touches are added, costs top out.

Construction can be financed by a construction loan, and interest payments are often the largest soft cost component. Construction loans allow interest to accumulate, with all accrued amounts added to the principal balance. This type of loan is referred to as a negative amortization loan. Hard and soft costs are relatively certain to occur, so the appropriate discount rate for the negative cash flow phase is quite low, as the discount rate always represents the riskiness associated with the corresponding cash flows.

In contrast, the positive cash flows derived from operating the property in the second phase are much less certain. The high risk (uncertainty) associated with forecasting future rent revenues and expenses demand a higher discount rate be applied to the income phase of a development pro forma. Thus, students should be aware that development IRRs are flawed, as the IRR calculation inappropriately assumes a single discount rate applies to all years. However, future revenue risk may be mitigated by pre-leasing to tenants or pre-selling to buyers. Revenue risks associated with tenants like GE are lower than for low-credit tenants. Pre-leasing helps mitigate some risk, but such agreements can lull a developer into a false sense of security since the tenant is legally obligated to sign the actual lease only if numerous conditions are met, some of which are often beyond the scope of the developer’s control.

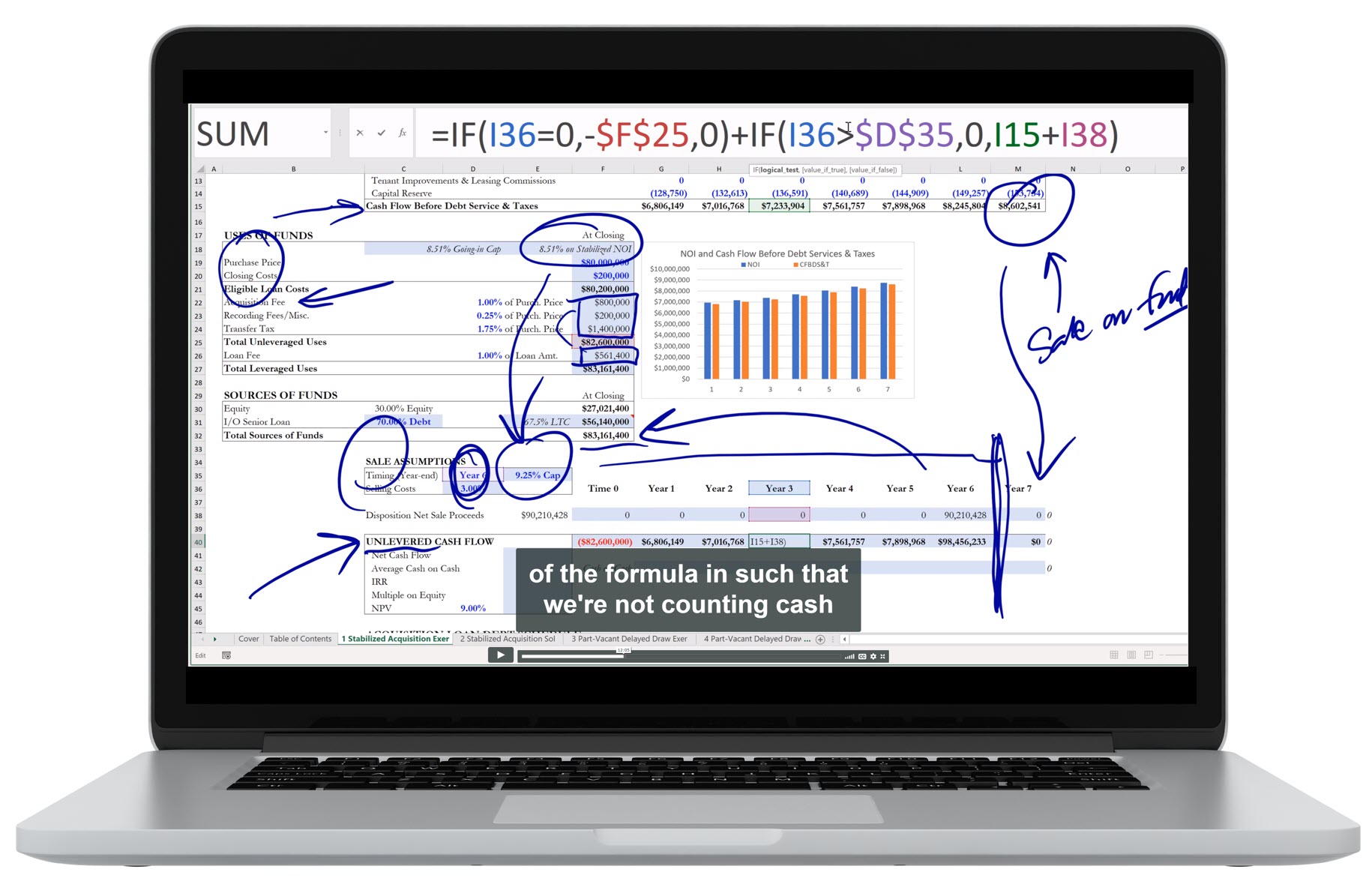

The going-in cap rate of a development is the projected stabilized NOI for the property divided by the expected total development cost. The going-out cap rate is the stabilized NOI divided by the developer’s projected sales price. The gross development profit margin is the expected pre-income tax profit margin (i.e., the expected going-in cap rate divided by the going-out cap rate minus 1), and is typically 15-25%.

Questions

These are the types of questions you’ll be able to answer after studying the full chapter.

1. What is a pre-lease agreement? Why would a developer want to pre-lease space?

2. What discount rate should a developer use when building a pro forma for a development project?

3. How do you calculate a gross development profit margin?

4. Calculate the (1) going-in and (2) going-out cap rates, the (3) gross development profit margin, and the 4) NPV of the project cash flow for the following development:

– Planning and Construction phase: Development is expected to take three years and cost a total of $11 million. The developer will incur a $4 million expense in the first year, $4 million in year 2, and $3 million in year 3. The 3-year Treasury rate is 2%, and the risk premium for the development is 50 basis points.

– Operating phase: The developer has managed to secure a tenant for the entire building with a pre-leasing agreement. Thus, the building will have a stabilized NOI of $1.2 million as soon as development finishes. The developer expects to sell the building for $15 million after a 3-year holding period. Expected revenue should be discounted at 7%.

Audio Interview

Development risk from the lender’s point of view

BRUCE KIRSCH: So let’s talk a little bit now from the lender’s perspective. When lenders look at a potential construction loan, really what they’re looking at from the beginning is, well, what’s the prospect of my principal being repaid, either through a permanent loan coming in and taking out the construction loan or if the property’s going to be sold from the net sales proceeds once the properties stabilized and then transferred to a new owner. Now we always hear talk about these loan to cost thresholds of 50% loan to cost and then also loan to value thresholds. What determines how they get to these numbers of 50%, 60%? And how does that all work?

PETER LINNEMAN: Well, first of all, on the development side, their biggest nightmare is that it doesn’t become a building. That somewhere between when they start funding and when somebody doesn’t pay them, it’s not a building. Because they’re lenders, not builders. They’re not even building operators, much less building creators.

BRUCE KIRSCH: Right.

PETER LINNEMAN: So however ill-suited a lender is to be the owner of an up and existing building, given all the complications we just talked about, they’re triply not suited to be a developer. So a lender’s number one concern with development is you’ve got to get me at least to where I have a habitable building, certificate of occupancy building. And so until you get me that, you are personally liable for the loan. Because I cannot deal with having an uncompleted building. It’s just way beyond my expertise. At least if I’ve got an existing building, I can hire Cushman and Wakefield to lease it, and I can hire somebody too– but a non-existing building is a mess, just a mess.

So that’s why they’re, first and foremost, fixated on whatever amount I give you, I have to be convinced that you’ve got the wherewithal and the expertise to finish the building. And so hence, their equity requirements in that regard and hence, their personal guarantees on finishing of the building. Now once you’ve got a building, then they’ll generally go and say, OK, I don’t have to have a personal guarantee anymore. At least I know what to do with a building if I take it over if you’ve got a certificate of occupancy. So usually I can get off a personal guarantee then.

When you talk about a loan to values, it gets back to how “out there” is it, and how aggressive are the lenders. The notion is that if you’re creating– a typical building, a typical development usually has a profit margin of 20%, 25%, just something like that. And so you go OK, the magic– the ingredients of the cake, including labor, cost 80, and I can sell the cake for 100. Right? Ingredients, including labor, and oversight of the building, cost 80, and when it’s done, it’s worth 100. Because that’s the return to doing all that brain damage we talked about and managing all that risk.

Therefore, what they will usually say is I need at least 20% equity. Because what if you build it, but it didn’t create any value. What if at all it’s worth is the ingredients? And given that as a rule of thumb, they’ll end up where a typical construction loan in a typical market would be something in the range of 70% to 80% of all costs, including land, including labor, including materials.

That often translates to saying, OK, the equity in the deal is you put up the land. You go buy the land, Bruce, as the developer. You control the land. And the land, let’s say, by the rule of thumb– not by reality, but by the rule of thumb– is 20% to 30% of the total cost. So if you put up the land, I’ll put up the rest of the construction cost. And that means we end up 70% to 80% total leverage on all costs, which means if you added no value, I still am money good. Because I’m going to take your land along with everything else.

BRUCE KIRSCH: Right.

PETER LINNEMAN: And so that’s crudely the thing. And then what they will say is on replacing it with a loan, that they’ll say typically lenders don’t want to do more than about 70% loan to value. So I’ve got to have some amortization on this so that when your loan is due, somebody will be out there willing to make a 70% loan to take it out at what I think the value will be then. So it’s all crude. If you go to Williston, North Dakota, it’ll be less loan available with faster amortization. Because what do I do if they stop drilling? If you go to midtown Manhattan, where land is a bigger component of the price, or Tokyo, where the land is a huge component of the price, I’ll lend you more even to help you buy out the land because that’s how the math works. But that’s a crude sense of where it comes out.

Excel Figures

Key Terms

To view the definition, click or press on the term. Repeat to hide the definition.

Development of a property without any contracts for pre-sold or pre-leased space.

The relatively little revenue that may be generated during the initial stages of real estate development but is expected to terminate at the start of construction.

The legal contract for the transfer of ownership of a property.

The purchase price of the site and associated transfer costs.

Costs relating to construction such as materials, labor, and construction contractor services.

Broadly defined as indirect costs (costs that are not land or hard costs); includes the costs of architects, engineers, and construction loan interest, as well the costs of legal services, insurance, and consultants.

A short-term loan provided by a lender for the purpose of new property construction. The principal amounts needed for incurred project costs are borrowed monthly (through a loan draw request) and loan interest accrues (accumulates) and is added to the loan principal balance.

Development company expenses such as project management salaries, back-office work, and accounting fees.

Changing the zoning classification of or the allowable uses on a site.

The paid exclusive right to purchase a site at a future point in time at a pre-negotiated price.

Document issued by a local government agency or building department certifying a building’s compliance with applicable building codes and other laws and indicating it to be in a condition suitable for occupancy.

The contracting with a future tenant of a new development that obliges the tenant to sign a pre-agreed lease upon construction completion.

Sale of residential units prior to construction completion; typically pre-sales are priced at a discount to pro forma pricing for completed units.

Build to an X means that projected NOI for the property upon stabilization divided by the expected total development cost equals X%; so to build to a 10 means that your stabilized annual NOI return is 10% of the total development cost.

To sell to an X means that stabilized NOI divided by your projected sales price is X%. Synonymous with the going-out cap rate.

A development project that is fully pre-leased and the tenant provides the design specifications.

Gross Development Profit Margin = (expected going-in cap rate / expected going-out cap rate) – 1

Chapter Headings

- Development

- The Two Business Phases of Development

- Phase I: The Negative Cash Flow Business

- Phase II: The Positive Cash Flow Business

- Certainty of Cash Flows

- Revenue Risk Mitigation

- Pre-Leasing

- Pre-Sales

- Delay Risk

- Opportunity

- Options and Development

- The Develop Versus Buy Analysis Framework