Overview

Chapter 5 details how to complete a property-level pro forma analysis. The chapter starts with a discussion of how leases determine an asset’s value. Credit quality of tenants and lease expirations are highlighted as critical factors. The chapter then discusses how a pro forma’s time frame will depend upon the type of the investment and major events occurring at the property (i.e., a major tenant vacating the building in the 8th year). It is prudent to carry out an analysis several years after such an event. The chapter then goes through the major line items on a pro forma.

Summary

Listen to this narration if you prefer

Gross Potential Rental Revenue (GPR) is the revenue you would receive if the building’s leasable space was 100% occupied. Gross potential rental revenue is calculated as the base rent multiplied by the property’s total leasable square feet. There is some Vacancy in fully stabilized buildings that results from tenants moving in and out as part of turnover and some space that is non-leasable. Rent consists of both base rent and percentage rent (overage). Tenant Reimbursements are payments specified in the leases, made by tenants to the landlord for specified property expenses, including insurance, property taxes, security, and utilities. Ancillary Income comes from all other activities conducted at the property. Credit Loss/Bad Debt Expense must be included to reflect the anticipated non-payment of rent. It is commonly estimated at 1-2% of expected revenues. The loss/expense will rise in weak economies. Operating Expenses are the costs required to effectively operate the property. Reimbursable costs are initially borne by the landlord, but the landlord expects full reimbursement for these expenses (typically all property taxes and Common Area Maintenance costs for occupied space). Non-Reimbursable costs typically include insurance, utilities, and managerial services.

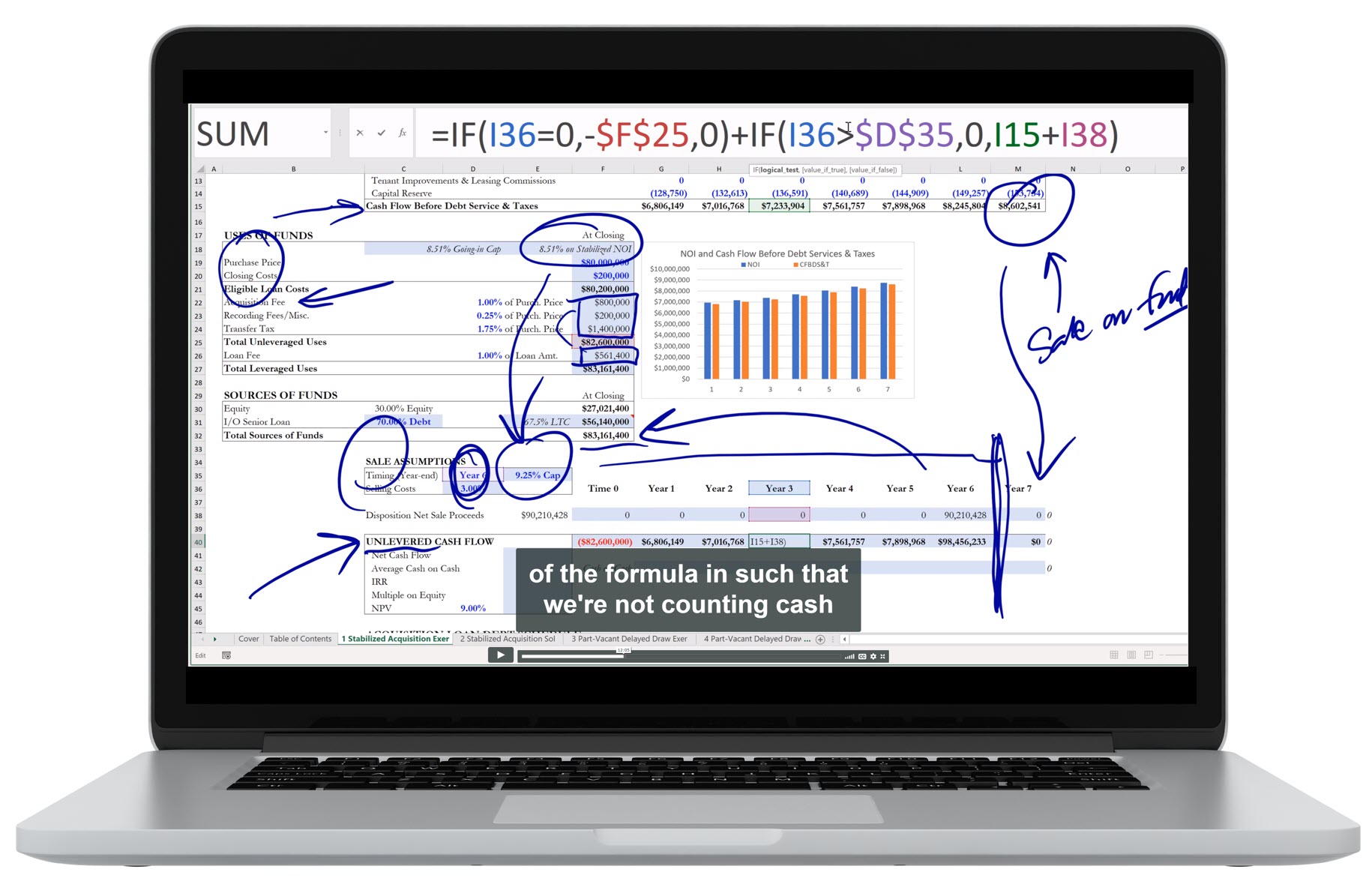

Net Operating Income (NOI) is defined as total operating income less total operating expenses. It is important to note that Adjusted NOI differs from NOI by including deductions for Tenant Improvements, Leasing Commissions, and Capital Expenditures. Tenant Improvements are improvements made to make leased space operational and acceptable to the tenant. In order to entice a tenant to occupy the space, the landlord will often agree to pay part of the tenant improvements. The negotiations over how much, if any, tenant improvements the landlord pays for are dictated by market conditions. Leasing commissions are the fees you pay to a broker or leasing company (sometimes a separate firm which you own) that leases your space to tenants. The timing of some Capital Expenditures (cap ex) is predictable. Many property owners hold reserves for such annual expenditures, and incorporate a reserve for normalized capital expenditures.

It is important to note that depreciation is an accounting concept and does not relate to the physical capital expenditures needed in a financial reporting period. United States accounting rules do not allow land to be depreciated. However, structures and building improvements can be depreciated according to well defined schedules.

To determine Net Cash Flow, subtract total operating expenses, cap ex, TIs, and leasing commissions from total operating income. The resulting Unlevered Cash Flow reflects the net cash inflow from a property before any financing or tax liabilities. To estimate cash flows to equity, one needs to incorporate debt and tax liabilities into their analysis. Specifically, loan points, amortization, and interest payments resulting from the use of debt financing all have an impact on the calculation of after-tax equity cash flow.

Questions

These are the types of questions you will be able to answer after studying the full chapter.

1. How does gross potential rental revenue differ from net rental revenue?

2. How does forecasted depreciation relate to actual capital expenditures?

3. What is a common source of differences between reported cap rates?

4. What occurred during the early 1980s to encourage excessive investment in U.S. real estate?

Audio Interview

Valuation from forward NOI (2:39)

BRUCE KIRSCH: What we learn in the book with respect to valuing an asset at sale is that the convention typically is to use this adjusted NOI number from a forward year, assuming that the building, the properties, in fact stabilize and growing at a relatively constant rate. Does this ever change in some market conditions or for certain property types where buildings are not valued off of forward earnings?

DR. PETER LINNEMAN: Generally people are valuing it off of forward. And the only thing is that there is usually a pretty good relationship between past 12 months and future 12 months.

Now that is to say, in normal conditions if I know the past 12 months it will look something like the next 12 months. But when situations are not normal– you’re in a recovering market. You’re in a declining market. You’re in a situation where lots of your leases are expiring. You’re in a situation where none of your leases are expiring. You’re in a situation where there’s a big rent bump. When it’s not normal, then it can be very different.

And that’s why people generally do it off of forward and really think through. Because I don’t own the past. You think of closing a building at the end of the year. Well, yeah, you tell me you made a million dollars. Well, that was a million dollars I don’t get. I get next year’s income, which is either going to be higher or lower than a million dollars depending on all those factors that we were just talking about.

So people say, I want to know what the cash stream is not in its history but when I own it. And I have to then try to analyze it. Now normally you look at leases and you do all that analysis particularly on properties like apartment buildings and hotels.

Your starting place is usually, what have you done in the last year? Or the last 18 months? Or 24 months? Because the leases are so short and you’re trying to get a sense of, let’s start with what you’ve done. Because I can’t read leases.

When I get to an office building, a shopping center, or a warehouse, a medical building, and so forth, then I really need to always look forward to the specifics of the leases in place. The cost structure in place, et cetera.

Excel Figures

Key Terms

Click or press on the term to see the definition. Repeat to hide.

The revenue you would receive if a building’s leasable space was 100% occupied, and all square footage was leased at market rent.

GPR net of vacancy.

A property at full occupancy, except for an expected “systemic” level of vacancy, whose NOI is flat or growing relatively smoothly year-over-year. For instance, a 100-unit apartment building with 4% yearly vacancy and 2.5% yearly NOI growth.

Churn in property occupancy when a tenant lease expires and they vacate.

Income generated from all other activities conducted at the property other than rental of suite square footage.

Financial analyses that change one or more assumptions to explore the impact of these changes on calculated outputs.

The first year’s rent for a leased space.

A form of additional rent that specifies the percentage of the tenant’s gross sales revenue that the landlord receives in addition to the base rent and escalations; helps to align retail tenant interests with those of the landlord.

A predetermined revenue threshold over which a percentage of incremental sales are paid to the retail landlord.

Net base rental revenue plus any percentage rent.

Payments defined in the leases, made by tenants to the landlord for specified property expenses such as insurance, property taxes, security, and utilities.

The costs associated with the operating and maintenance of areas and services that benefit all tenants such as the lobby, hallways, parking areas, security and snow removal.

The portion of CAM costs that are billed to tenants.

The portion of property tax costs that are billed to tenants.

The anticipated non-payment of rent and other revenues; usually 1-2% of the Expected Gross Income; rises in a weak economic environment or as your tenant quality profile deteriorates.

Gross Income less Credit Loss.

The costs required to effectively operate and maintain the property.

Operating expenses initially borne by the landlord that are paid for at least in part by one or more tenants.

The amount per $1,000 used to calculate real estate taxes. The millage rate is multiplied by the property’s assessed tax value to generate the tax liability.

The dollar value assigned to a property to calculate applicable real estate taxes.

Operating costs without the negotiated right to reimbursement from tenants.

The fee paid to the property manager for fulfilling the associated scope of work (collecting rent and overseeing daily operations, including maintenance and repair and janitorial programs).

The sum of all reimbursable and non-reimbursable operating expenses.

Total Operating Income less Total Operating Expenses; summarizes the property’s ability to generate income, irrespective of capital structure.

The collection of property-related expenditures critical to attracting and retaining target tenants, and to maintaining both a high property operating standard and the integrity of the physical plant. Examples include roof repair, elevator replacement, boiler replacement, and parking structure repair.

Funds set aside that provide for the periodic major repair or replacement of building components that wear out more rapidly than the building itself. Senior lenders require minimum capital reserves be set aside and maintained to ensure continued property competitiveness.

Interior space physical improvements made to make tenant space habitable, useful, and pleasant.

Tenant improvement scope of work budget provided by the landlord.

The fees the landlord pays to a broker or leasing company that leases their space.

Dollars spent by the landlord for the repair or replacement of major property elements not located in tenant premises, such as the boiler in the basement, the air conditioning chiller on the roof, elevators, and the parking structure. Capital expenditures reflect the property’s actual wear and tear, for which you must spend money to keep the property in competitive condition.

NOI after the deduction of capital and leasing costs; “unlevered” refers to the lack of impact of any debt financing in the calculation of the cash flow, and as such, like NOI, unlevered cash flow also reports property performance irrespective of capital structure.

Unlevered cash flow in a forward-looking financial modeling context, where the adjustment to NOI references the deduction of normal reserves.

An IRS-based allocation mechanism providing the multi-period schedules on which you are allowed to deduct the cost of capital expenditures for income tax calculation purposes.

An accounting method that reduces taxable income based on IRS rules, such as depreciation of capital expenditures.

What the property owner will owe in annual income tax.

Unlevered cash flow minus total debt service (interest payments and any amortization).

The income amount to which the tax rate is applied. Calculated as before-tax levered cash flow less depreciation, plus TIs and cap ex and loan principal amortization, less loan points amortization.

The amount of the property purchase price that can be depreciated. Land is not depreciable in the U.S.

The rate at which an item is depreciated (e.g., 1/39th per year for the structure of an office building, which has a 39-year depreciable life).

The amount of time over which an asset can be depreciated: 27.5 years for residential properties and 39 years for all other property types. Land is not depreciable in the U.S.

An analysis of all of the unique depreciable elements of a property that tracks the individual depreciation amounts based on the appropriate schedules.

Unlevered returns on an investment (i.e., if the property were acquired only with cash).

The expected before-tax and after-tax cash flows exclusively to equity.

The fee paid to the lender to compensate for the lender’s underwriting costs.

The combination of both interest and principal payments made.

A legal entity structure, such as a Limited Liability Company (LLC) or Limited Legal Partnership (LLP), that allows for the tax liability of a property to be passed through to the individual members of the entity.

The ability for a property owner can use a prior year cumulative Taxable Losses to offset subsequent year tax liabilities.

Accumulated income tax losses that can be applied against taxable income for the current or a future tax year.

Chapter Headings

- Lease-by-lease analysis

- Line item analysis

- Operating Income

- Gross Potential Rental Revenue

- Vacancy

- Percentage Rent/Overage

- Expense Reimbursements

- Ancillary Income

- Credit Loss/Bad Debt

- Operating Expenses

- Common Area Maintenance

- Property Taxes

- Insurance

- Utilities

- Property Management

- Net Operating Income

- Capital and Leasing Costs

- Tenant Improvements

- Leasing Commissions

- Capital Expenditures

- Unlevered Cash Flow

- Cap Ex Versus Depreciation

- Purchase Depreciation

- Depreciation of TIs and Cap Ex, Part 1

- Levered Cash Flow

- Loan Points

- Debt Service Expense

- Taxable Income

- Depreciation of TIs and Cap Ex, Part 2

- Amortization of Loan Points

- After-Tax Cash Flow to Equity

- Losses

- The Crazy 1980s

- Closing Thought

Learn about REFAI Certification

< Ch 4 | The Fundamentals of Commercial Leases

Ch 6 | Financial Modeling >

Table of Contents

Index

Buy the Book