Overview

Listen to this narration if you prefer

The value of a property can frequently be estimated using cap rates, replacement cost, and the Gordon Model, all far simpler methods than discounted cash flow (DCF) analysis.

Summary

Cap rates are generally used in real estate valuation analysis and are the inverse of a traditional corporate earnings multiple. A cap rate is defined as stabilized NOI divided by property value (stabilized NOI/property value = Cap Rate). Cap rates are determined by the market as the expected yield an owner should get on a stabilized income-producing property given a certain risk level (similar to valuation of coupon-paying bonds). Market cap rates change as the market perception of risk, cash flow, or growth changes. While cap rates are a good “quick and dirty” tool for pricing real estate assets, students should be aware that cap rates can only be applied when using stable NOI estimates. Determining the stabilized NOI of a property is a subjective matter and can result in very different valuations for the same property.

Replacement cost gives an indication of what it would cost to build the same building today and can sometimes be used as an additional tool to estimate the value of a property. If a building sells for more than its replacement cost, an investor might be better off developing a new building instead of buying the existing one, and vice versa.

The Gordon Model [NOI/(r-g)] helps approximate the DCF value of a property that has a constant expected NOI growth rate in perpetuity. Students can use the Gordon Model to estimate value if the projected NOI is expected to grow at the same rate (g) per year indefinitely. The growth rate must be smaller than the discount rate (r) when applying the Gordon Model. If a property does not meet these “stabilized” criteria, using the Gordon Model will result in unreasonable valuation estimates (negative or infinity). In this case, a full DCF analysis is needed.

Questions

These are the types of questions you’ll be able to answer after studying the full chapter.

1. What is the difference between a cap rate and a multiple?

2. Calculate the value of a building that has a $1.2 million stabilized NOI at an 8% cap rate.

3. What is the difference between a cap rate and a multiple?

4. A building has a $3 million stabilized NOI and was recently sold at $21.6 million. At what cap rate was the building sold? How much risk premium does this building have over a 10-year Treasury note that yields 2.6%?

5. Does a seller prefer higher or lower cap rates?

6. What is replacement cost? When is it used?

7. When should the Gordon Model be used in a property pro forma?

Audio Interviews

Cap rates vs. cash-on-cash return (7:49)

BRUCE KIRSCH: We start to talk about capitalization rates, which everybody abbreviates as cap rates. And it can be a little bit tricky with cap rates because cap rates are at the same time the determinant of a property’s value but also simply mathematically the result of a property’s value given a certain assumed NOI stream. And so this somewhat circular nature, I think, can be confusing for students. How can a student reconcile these two things in their head– the property value and the cap rate?

PETER LINNEMAN: Well, I think it’s very simple because it, as you describe, picks up two different things. If you start with the simplest one, if I bought something that has a million dollars in let’s say prospective NOI, and I’m buying it for $10 million, we’d say the cap rate– you and I would both say the cap rate on that purchase was 10. And yeah, we would basically be saying, is that a stabilized income stream? And were there adjustments to the purchase price because you got special financing? And yeah, we’d make all those adjustments.

But unless there’s a special story, if you bought something with a million cash stream for $10 million, you’d say it’s a 10 cap. And everybody in the business would understand. It’s more or less that math. And nobody would believe it’s exactly that math. There’s a lot of little shades of gray in both the numerator and the denominator, both the income and the value.

So one way it’s used is as you suggest just a descriptive. And everybody in the business knows that it isn’t quite as precise as you say, especially given we’re using prospective income. Because who knows what perspective income really will be?

So part of it is just truly using it as a descriptive. It’s nothing more than a shorthand to give people some sense of what the pricing is. Then you go to the flip side of that same coin. And the flip side of that coin is if you and I as professionals were talking, and I’d say, I’m not willing to buy it at a 10 cap, it has to be a 10 and a quarter cap, what you would know is that I think it’s a little bit overpriced but not crazily overpriced. There’s a 2 and 1/2% that I think it’s too much. 10.25 versus 10, the difference is 2 and 1/2%.

And so, OK, you’d know that what I meant is in that range, but you got to bring it down a little in price. And it’s again just language. It’s code language. And you would know that you don’t achieve that simply by redefining things but that I really believe the price is a couple percent too high. We got to make some adjustments somehow.

Or there’s not going to be a transaction. Or if I’m a seller, I’d say, I need a 9 and 1/2 cap. And you’d say, oh, we got to get a 5– to 5%. That’s a big gap. I don’t know if we get there.

So as used among professionals, it’s language. It’s lingo. And everybody’s making these conversions kind of like I’m saying. It’s not used with quite the precision that I think students think it might be being used with with this extreme mathematical precision in either case either as a descriptive of what I am going to do or a descriptive of what I have done so much as an indicator of where my head’s at.

And it’s almost like flying. The beauty of flying is it’s precise in precision. Cap rates have that. It’s very quick professional slang to both describe where my head’s at and where a transaction occurred.

BRUCE KIRSCH: Right. And one of the things that students ask me about cap rates is, well, why is this one of the most relied-upon metrics? If we’re going to end up putting debt on the transaction, doesn’t it make sense to look at the cash on cash return? And I tell them that the NOI and the cap rate, which is the yield on the purchase price, is really the purest measure of the income-producing characteristics of the real estate.

PETER LINNEMAN: The purest, simple one. I mean, you could make it more complex by saying, well, in the first quarter, the cap rate should be in the fifth quarter in the 19th quarter. And that’s all there. But if you’re trying to– again, it’s a shorthand language. It is just a descriptive that if I tell you what the property is, I tell you the nature of the property, its lease, and its location, and what I think rents are going to grow, it is a pure descriptive.

Now, it’s not the only thing you look at. You look at a lot of things, starting with where it’s located and what the leases are and who are the tenants and do you like the design and real real estate stuff. But it is a simple descriptive.

And the cash on cash is a bit of a different statement. It’s not telling you about the property whereas a cap rate is telling you, as you describe, the cash-generating ability of the property at least in your belief relative to the price you paid or will pay. The cash on cash is telling you that. But it’s also mixing in with it how you chose to finance it. And it’s a very useful and important piece of information.

But it is not– and I think your word is right– pure about the property. It’s also telling you about the type of debt you got and how much leverage you chose to get. Well, that’s the choice of do you want to eat your pasta on a paper plate, a plastic plate, a silver plate, a fine china? The pasta is still the pasta.

So you can think of the cap rate talking about the pasta. The cash on cash is telling you about not just the pasta but how it’s served to you. And depending on your circumstances, you may want paper plate or fine china. And one is not right and the other wrong. It’s what are you dining at? What is your preference? What is your risk tolerance and so forth?

And so cash on cash, as you know, I could borrow for truly overnight in today’s market for essentially zero interest rate. So I could tell you my cash on cash is really huge. But it’s only for one night. Tomorrow, the debt’s due, and it’s a different answer. And I’m at risk that I can’t repay the debt tomorrow and all those kind of financing risk and leverage good and bad. The cap rate’s telling you about the property, not my decision of how to finance it.

Cap rate spreads (5:35)

BRUCE KIRSCH: When people talk about cap rates, there is often a mention of spreads. And for people who don’t come from the finance world this is totally mysterious, so can you just enlighten us what does it mean if spreads are expanding or contracting? Because when I first heard that my eyes glazed over.

PETER LINNEMAN: Yeah. I mean, it’s a great question. And let me just regress one moment, most equity sectors, if you’re buying companies, if you’re buying stocks, they tend to refer to price earning multiples. And that’s because that’s been the nomenclature of equity for a long time. When you go to the debt side of things, they’ve always historically spoken about yield, namely income to price.

Obviously one is just the inverse of the other. Price divided by income is the inverse of income divided by price. Real estate, going way back in its history, used to be about signing real long leases with high grade tenants and you got your rent and there wasn’t much inflation so you pretty much got the same rent forever.

And therefore it kind of had a debt like dimension of a fixed income that didn’t change much divided by a price. So people in real estate tended to talk and yield or cap rate context rather than multiple, and the only reason the multiple is gee, since the earnings changed more people felt it was a better metric.

When you started describing real estate pricing in the debt world, the obvious question that the debt world always did was, OK, your corporate bond is yielding 8%, what is the spread between your corporate bond and comparable maturity treasury? And that’s the spread that people would talk about in the bond world, a 10 year corporate bond versus a 10 year US treasury. And you’d say, oh, the difference is the treasury is at 3% and the corporate bond’s at 5% and it’s a 200 basis point spread. My bond had a spread of 200 over.

And if you think about where the income for, at least the office buildings, and warehouses, and medical buildings, industrial, it comes from tenants signing these leases. So the spread notion came from well, OK, it’s kind of like a corporate bond. It’s not but it’s kind of a fixed income stream associated with a certain credit. Tell me what the spread is over treasury.

So if I told you your cap rate is 8% on a piece of real estate the spread says, well, tell me what the spread of that yield, that cap rate is over the yield on a treasury. Well, real estate is how long lived and the answer is real long. So you can’t do quite the matching you can with a corporate bond and the generic thing people have done, at least in developed countries have said, well, let’s take it versus 10 year treasury.

Not because anybody says that the duration of a piece of real estate is 10 years, but rather because 10 year treasuries are very liquid, they’re highly quoted, they’re easily found out what their quote is, and again, is a matter of language.

So if a cap rate is 8 and 10 year treasuries or at 3%, you’d say 8 minus 3 is 500 basis points. That is there’s a five percentage point or 500 basis point spread. And nobody finishes, again it’s slang like, nobody is finishing the full sentence. As professionals we’d say I’m buying it an 8 cap and that’s a 500 spread but what you’re really saying is an 8 cap on prospective income is 500 basis points, initial yield above a 10 year treasury yield.

It’s a sense of how much extra am I being compensated versus just taking a 10 year treasury.

BRUCE KIRSCH: And so really the spread, or the premium, that you pay in essence above treasury is a symptom or a reflection of the additional risk that you’re taking on with the real estate, is that right?

PETER LINNEMAN: That’s the spirit. And the reduced liquidity. Nothing is as liquid as the 10 year treasury. You give me the most liquid piece of real estate in the country, it’s not as liquid as a 10 year treasury. So the fact that my yield has to be higher, that is you have to give me more income, to get me to pay any given price, the fact that you have to give me more income to get me to pay any given price means that the risk is higher and the liquidity is lower. And the combination of those, you have to essentially bribe me or induce me to buy your asset or I’ll just go buy a treasury.

Future cap rate selection (8:33)

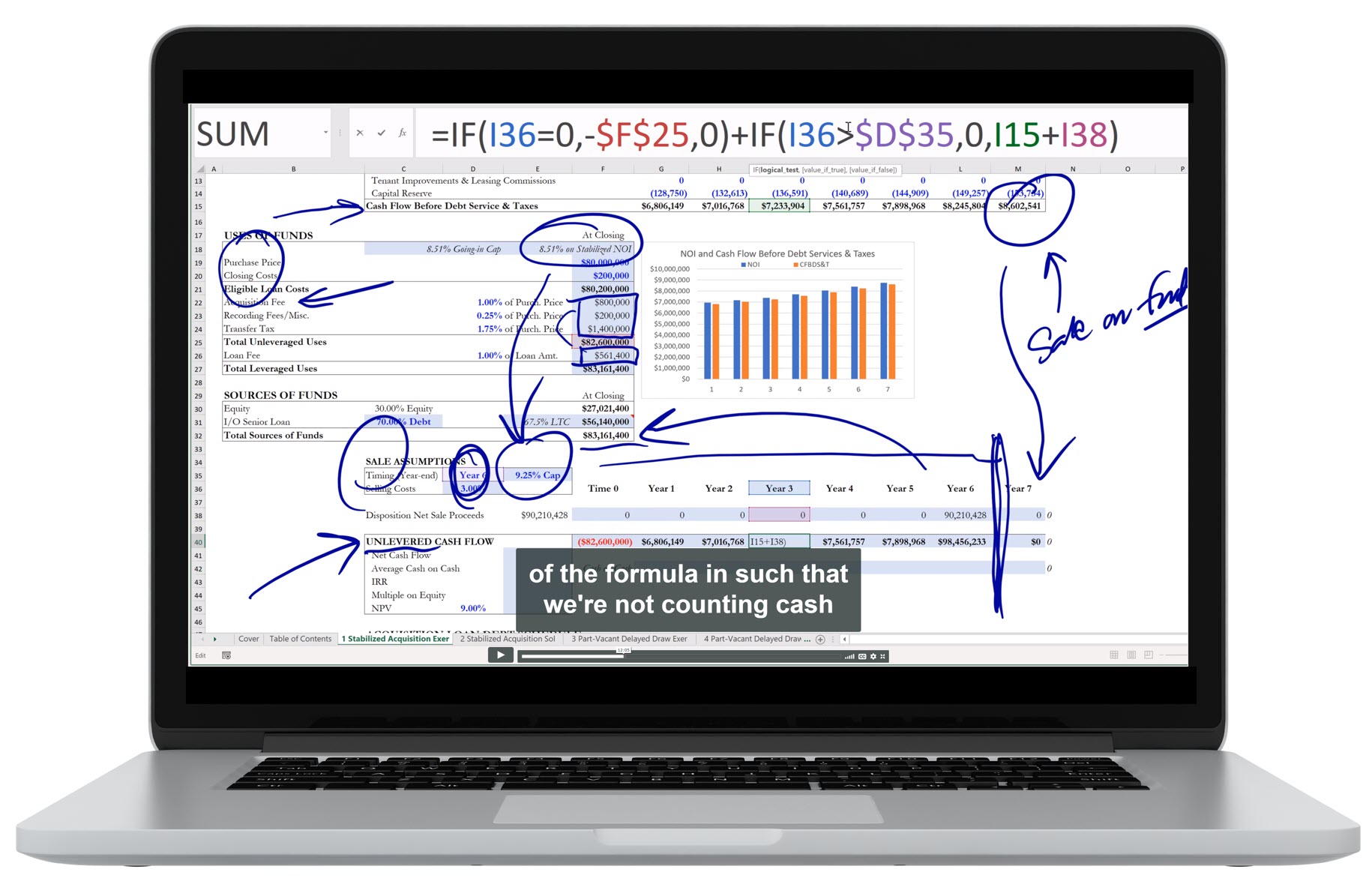

BRUCE KIRSCH: When purchasers acquire a property the cap rate at which they acquire it is simply a mathematical calculation once the transaction is done.

But when they make projections and look forward into some sale year in the future, in order to complete the pro-forma analysis they need to assign some future cap rate at which they anticipate they’ll be able to sell.

And naturally, the lower the cap rate, the more valuable the asset. Is it realistic for property owners to forecast a lower cap rate than the cap rate at which they purchased?

DR. PETER LINNEMAN: No. Generally there are exceptions. But generally you would expect the cap rate would be the same to higher.

The same is, the world doesn’t change. My property doesn’t change in its competitive position. The liquidity of my asset doesn’t change relative to today. And my interest rate environment that exists– nothing changes– is the same cap rate.

And there are times where, by the way if you were going to sell six months later maybe believing you’re going to sell at the same cap rate is a good thing.

Because how much do you think the world’s going to really differ in six months? If I’m going to plan to sell in 10 years the world could be a lot different in a lot of ways. Interest rates could be different. The competitive environment could be different. My property could be different.

Generally, if you anticipate holding for a reasonably long period– say seven to 10 years– generally you’d believe that no matter how much capital expenditure you do and how well you maintain your building, your building slowly is not as competitive as it once was. Slowly.

Somebody is going to build a new building. Somebody is going to renovate an old building in the market to bring it up. And even though your building may not have changed the other people are running a little faster.

To the extent your building isn’t quite as competitive as it used to be, you’re going to have to give people more income for the same price. That is, your cap rate would go up.

So as a general matter I would say, you should anticipate your exit cap rate on a seven to 10 year hold being somewhat higher than your purchase cap rate.

And you can always come up with exceptions, but that’s a general rule of thumb where all it’s reflecting is, as much as I might like, my building won’t be quite as competitive in 10 years as it is today.

BRUCE KIRSCH: Right. Now there is a potential situation where, while your property does age and becomes relatively less attractive to new stock or renovated stock that’s brought into the market, if, as a trend in your sub market, cap rates are compressing on a net basis it could end up being a wash, right?

DR. PETER LINNEMAN: It could be more than a wash. And I’ll give you a very simple example. You go back to after the Iron Curtain fell and the Soviet bloc collapsed. And people would be buying in Poland at cap rates of 10, 11, 12, 13.

And even though they knew their buildings would probably be eroding in their competitive position within the market over the next decade, the general belief is Poland was going to integrate from being part of the old Soviet empire into part of Western Europe.

And as it became part of Western Europe its risk would diminish. Its liquidity will increase. And therefore there was a belief in the secular decline in cap rates.

Namely, since I’m not dragging you to the Soviet Union, since I’m not dragging you to a non-liquid market 10 years from now, they’ll be a better cap rate. A lower cap rate.

Now that’s a risk you’re taking if you’re going to bet on that. But that was the most notable example I’ve seen in my life.

Interestingly as we sit here today there’s kind of an opposite situation, which is you’ve got 10 year treasuries at historic lows– the lowest they’ve been in 70 years. You’ve got interest rates sitting there.

And so people are saying, well, yeah, if interest rates stay where they’re at– 10 year treasury at basically 2% or less– the cap rate should be 5%. But do I really believe 10 years from now that the 10 year treasury will still be 1.7%?

Nobody is going to know for 10 years what the answer is. And you’ve got a lot of people saying, you know, I think there’s too big a chance the interest rates rise, having nothing to do with me over the next 10 years.

So I’m going to put the cap rate in 50 to 100 basis points higher for my exit than my entrance as a cushion. Now only time will tell if that was a good assumption or not. So you have to evaluate circumstances.

The starting point is, nothing changes. The same exit and entrance. Nothing changes. And then you have to say, what do I think change, and why, and then that’s what you’re relying on.

BRUCE KIRSCH: Right. And I think it’s important that students run these numbers just for their own edification at different cap rates to really come to appreciate the sensitivity of a transaction’s performance off of a basis point.

Because if you’re running a sensitivity table and your interval for your cap rate is 1% it’s kind of silly, right?

DR. PETER LINNEMAN: Right. Well, and you add to your sensitivity the equity, if you’ve leveraged. The power of leverage is if the cap rate moves for you– that is, it falls from when you buy– you do spectacularly. But it’s just as punishing in reverse. It’s wiping out.

And the one thing that I find a lot of people miss when they do cap rate sensitivity think is they go, well, you know– I just say, we were talking about should I pay a five cap, a five percentage yield to start with.

And you go, OK. I’ll go to a four and a half cap. It’s only 50 basis points. That’s nothing. You go, wait. 50 basis points on 500 basis points. Half a percent on five– that’s 10%. That’s a huge price change that I’m talking about. I mean, that’s huge, right?

So you have to think about them as a percentage change matter. So if I went from five to 4.99 it’s to your point. It’s a rounding error in terms of it. If I went from a 20 cap to a 19 and 1/2 cap it’s kind of a rounding error.

But if I go 50 basis points– the same 50 basis points– from a five to a four and a half, that’s 10%. So you’ve got to be aware of your sensitivity is more about percentage changes in price than absolute number of basis points. You’ve just got to always focus on that.

And especially when cap rates get very low people sometimes lose sight of the fact, thinking it’s only 10, 20 basis points. 10, 20 basis points– nothing, if you’re talking about very high cap rates. But it’s a big percent you’re talking about low cap rates.

BRUCE KIRSCH: Right. I mean it’s kind of like a faucet that’s very sensitive.

DR. PETER LINNEMAN: That’s exactly right.

BRUCE KIRSCH: If the water is really hot, making it slightly hotter– then you have to pull your hand away, even though you didn’t change it very much. But you know, it’s starting out at this very potent temperature to begin with.

DR. PETER LINNEMAN: Very well said.

The ideal split of cash flow: operating vs. residual (4:57)

BRUCE KIRSCH: One of the things that we look at in the textbook when we look at a pro forma, let’s say it’s a 10 year hold period, is when all is said and done and when the dust settles, we have some net cash flow to equity number which includes both operating period cash flows and then the net proceeds from the sale after any debt has been repaid.

And one of the metrics that investors, especially institutional investors like to look at is, what’s the percentage of that total net cash flow that is related to just the residual versus the operating period? And so, there is some threshold above which investors don’t want to go, in other words, a really terrific sale can absolve a lot of sins along the way. But where’s sort of the safe zone where you want to get?

PETER LINNEMAN: It depends, interestingly we’re in an odd moment in history because of these extremely low interest rate environment that exist today, where your alternative is a 10 year treasury at one and a half, 1.7% and it has created a situation where for really high quality assets, really high quality cash streams. And very liquid markets that people want to be in, central New York, central DC, the cap rates have gotten bid to a very unusual position where in a seven year hold you may only be getting 25%, 30% of your investment back through cash flow over a seven year period and 70% of it’s coming from the residual.

I say that’s an anomaly of that for those assets the cap rates have gotten very low, the spread over treasury is very low, and treasury is low and so you aren’t getting much of your money back and institutions are kind of swallowing hard and saying, yeah but it’s such a great asset in an uncertain world.

More normally, I would think that the world more normally in my career says I’m going to hold at 7 years, I roughly want half of my money back from cash flow over the seven years and I’ll take the rest of my return from the residual.

And if you think about it, it says gee, if I can get a 7% cash on cash for seven years, there’s no magic to it, again, it depends on the nature of the property. You show me something very risky, I’ll give you a great example. There’s a place called Williston, North Dakota where the fracking related oil fines have caused an explosion.

So, here’s nowhere land right? There’s nothing near it, you have to truck everything in, and by the way it is a huge economic growth area as long as oil prices stay above $70 a barrel. And what happens if oil prices fall to $68 a barrel? Well, it’s no longer profitable to extract the oil. Shut down in a heartbeat and suddenly all this drilling stuff will stop until prices go back up above $70 a barrel.

You talk about a market like that where the only reason they’re there is because oil is above $70 a barrel and as long as it’s above $70 a barrel there’s a lot there, but if not, there’s nothing there, it’s a ghost town. Tell you what, I better get all my money back in two to three years, all of it back in two to three years. Because I have no visibility on what the market looks like for oil in three years. I mean, I can make a guess but if I’m going to where it is either a ghost town or a boomtown on a razor’s edge, I tell you what give me all my money back.

Afghanistan, suppose I gave you a building that you could build and leased to the US government for two years in Afghanistan. So if you build it, the US government will lease it for two years. You’re going to tell me I want all my money back on a profit in two years from cash flow because you’re afraid that if the US government leaves in two years, you’re stuck with a building in Afghanistan nobody wants and I’ve got to get all my money and profit.

So those are kind of the extremes but if I had to say on a seven-year-old norm, 35% would be on the low side, 75% of my money from cash flow would be on the high end, 50% being kind of on the most normal leverage. This is not with abnormal leverage. That would be the range.

Cap rate comparisons across properties (3:36)

BRUCE KIRSCH: Students will often ask me about cap rates. What has a higher cap rate? A retail or apartment? So for instance, if we’re looking at a mixed-use transaction, where you have residences above and ground floor retail, you would ideally like to be able to assign different independent cap rates to the retail component and the residential component. And so people want to know, which one should have a higher cap rate.

PETER LINNEMAN: Right.

BRUCE KIRSCH: And the answer is like, most things in real estate is, it depends.

PETER LINNEMAN: Yep, there’s no mathematical answer to it. Or you can’t go to a website and find the answer. You actually have to think about it. It depends on risk and liquidity. And is the retail in your example, low risk, leased to Publix supermarket– a very high-credit supermarket– for 20 years in central Manhattan. So even if Publix were to leave, there’s going to be plenty of people who would love to have that space. So my retail would have a very low cap rate, about as low as you could get.

On the other hand, take the same physically designed retail, and put it in suburban Kansas City, with a startup retailer selling used dresses. And if they move out, I don’t know who I’d replace them with. It’s very different.

BRUCE KIRSCH: Right.

PETER LINNEMAN: And both of the sense of who would I sell it to and who would I replace them with, and also the credit of the party there– so the same way on apartments, you get me in a very strong apartment market, where people are anxious to invest because they want exposure there– New York, Los Angeles, San Francisco, DC. Cape rate is going to be low on multifamily because I can always replace one tenant. And there’s always money for it.

You get me an apartment building in Detroit, where the population is shrinking the occupancy is weak and no capital wants to go there, cap rate is going to be very high. So risk and liquidity, risk and liquidity– and you could give me a building that has apartments on top and retail on the bottom. And depending on its design location and specific tenancy, I’ll tell you the retail has more or less risk, more or less liquidity. So it’s not a kind of universal answer. You actually have to think– risk and liquidity, risk and liquidity, how does it stack up?

BRUCE KIRSCH: And I try to explain cap rates to my students as it’s really a reflection of the attractiveness of the nature of that particular cash flow stream.

PETER LINNEMAN: That’s it. Not one in another location, in another building, with another lease, with another tenant– that one.

BRUCE KIRSCH: Exactly, exactly. So it gets down to the actual physical location granularity.

PETER LINNEMAN: Absolutely, absolutely. And quite honestly, that’s what makes it a profession if you think about it. If it was as simple as go to a website, cap.com, and it would tell you it would be formula, rather than a profession. It’s a profession because you’re constantly making and revising those judgments.

Key Terms

To view the definition, click or press on the term. Repeat to hide the definition.

Estimates the value of a property by multiplying next year’s “stabilized” NOI by the price-to-NOI multiple for which comparable properties are selling today. The price-to-NOI multiple is the reciprocal of the cap rate.

A property’s “stabilized” NOI divided by its value (purchase price, either actual or anticipated), expressed as a percentage. The cap rate is the inverse (reciprocal) of the income multiple.

A property at full occupancy, except for an expected “systemic” level of vacancy, whose NOI is flat or growing relatively smoothly year-over-year. For instance, a 100-unit apartment building with 4% yearly vacancy and 2.5% yearly NOI growth.

NOI for a stabilized property (a property at full occupancy, except for an expected “systemic” level of vacancy, where the NOI is flat or growing relatively smoothly year-over-year, e.g., a 100-unit apartment building with 4% yearly vacancy and 2.5% yearly NOI growth).

An approximate “normal” level of capital reserves for an operating property.

Unlevered cash flow where the adjustment to NOI is the deduction of normal reserves.

The hypothetical amount it would take to acquire the land and construct an existing property today, including the cost of the LCs and TIs needed to attain the exact same tenant profile.

A hypothetical never-ending cash flow stream.

Converts perpetuity DCF analysis for a cash stream growing at a constant rate into a simple cap rate approximation by dividing stabilized NOI by the difference between the property’s discount rate (r) and its NOI growth rate (g).

The required expected annual rate of return that is used to reduce future projected cash flows to their present values. The discount rate for a property is theoretically composed of four factors: the long-term risk-free rate (approximated by the yield on a 10-year U.S. Treasury bond), expected economy-wide inflation, the risk premium associated with unexpected outcomes in the property’s NOI, and the risk premium associated with the property’s illiquidity relative to a 10-year Treasury bond.

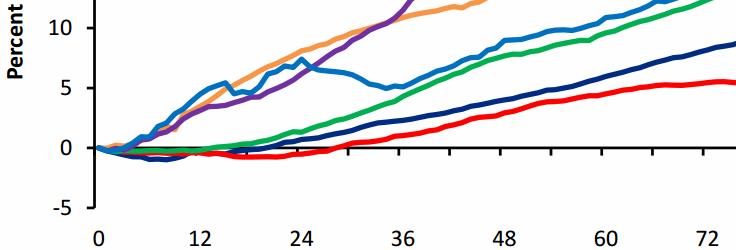

The margin of property cap rates above the 10-year U.S. Treasury. The spread increases when investors seek safety in government bonds, driving their prices up and yields down, and it decreases when investors perceive a decline in risk associated with real estate cash flows, causing them to move from government bonds into real estate positions.

Public company REIT yield calculated as the trailing 12 months’ reported NOI adjusted for non-recurring items, divided by the market capitalization and outstanding debts, less the value of non-income producing assets.

A proxy for property income yields after normalized reserves are deducted for tenant improvements, leasing commissions, and capital expenditures.

Operating cash flows driven by rent and occupancy levels.

Chapter Headings

- Basic Cap Rate Valuation

- Not Everyone Agrees

- Replacement Cost

- Gordon Model: Simple Cap Rate Estimation

- Let Your Common Sense Prevail

- Market Change

- Responding to the Market

- A Look at the Past

- Contractual Information