Overview

Listen to this narration if you prefer

Chapter 18 discusses property ownership exit strategies. Real estate owners sell properties for various reasons. Developers are in the business of creating buildings and may need cash for new developments. Additionally, REITs or local operators may have a comparative advantage over a developer in managing stabilized properties. Another reason to exit is to alter your risk-reward profile. For example, real estate private equity funds generally exit investments after repositioning a property, as a longer hold decreases the IRR. There are also old-fashioned reasons to exit, such as estate sales, divorces, and partnership dissolutions.

Summary

The simplest exit strategy is fee simple disposition (an outright sale). Depending upon the building and market, a “typical” sales process requires 3 to 12 months. Generally, the sales process will cost an owner 2% to 5% of the property value. This sum includes fee payments for lawyers, accountants, and brokers. If you have a trophy asset, the fees as a percentage of value may be substantially less, because the amount of work and value added by the brokers are not large relative to the value of the property. It also must be noted that a lender may require a prepayment penalty or a yield maintenance fee for repaying a loan prematurely at a sale.

In the U.S., capital gains taxes will be payable upon sale of a property. Under U.S. tax code, there are two components of the capital gains tax. The first component is a (currently 15%) tax on the actual gain that you achieve from the sale of the building. The gain is the difference between today’s sale price and what you originally paid for the building. The second component is a (currently 25%) tax on the property’s accumulated depreciation. It must be noted that if you are a non-taxable entity, such as a pension fund, the capital gains tax is zero.

An alternative exit strategy for a real estate owner is refinancing – taking out a new loan on the property. The refinance process is not free, although it is much cheaper than the sales process as you do not have to pay capital gains taxes associated with selling the property. You will probably have a 50-basis point loan fee, as well as legal and accounting fees. If you plan to sell the property soon, the refinancing option makes no sense; however, if you intend to hold the property for the long term, the present value of the deferred capital gains tax liability is effectively zero.

Listen to this narration if you prefer

Another exit option is U.S.-specific. It is the like kind exchange (“1031 exchange”), which allows you to sell your property free of state and federal tax if you purchase a similar property, thereby forestalling the capital gains taxes until you ultimately break the ownership chain. During a like-kind exchange, you will exchange your partnership interest for an interest in a different partnership. The exchange is not taxable until you sell your interest for either a non-real estate asset or a property outside of the United States. In a like-kind exchange you typically have 3 months to identify another property. There are volumes of ever changing tax laws written around these types of exchanges and the nuances constantly evolve. Like-kind exchanges are permitted on both improved and unimproved property.

There are two noteworthy ways through which one can benefit from like-kind exchanges. The first involves selling a stabilized building for a building where there is the opportunity to add value. This allows an investor to defer their capital gains taxes while capitalizing on a new opportunity. The second involves selling a property and buying a stabilized building that offers a better refinancing opportunity and little management burden. Such an example may be a long-term leased building to the U.S. government. With such a credit tenant, a lender will typically allow you to finance the acquisition with a greater loan-to-value, thereby allowing you to take more money off of the table.

To exercise a 1031 transaction, you will appoint an independent specialist, known as a QI, or a qualified intermediary, to help sell the property. The qualified intermediary will set up an agreement so that an escrow agent transfers the property to a buyer, and the sales proceeds go directly to the qualified intermediary. The exchanger must then acquire a property within a set number of days. It should also be noted that it is nearly impossible to find a property worth the same as yours. For this reason any excess gain is taxed, with this excess known as the “Boot.”

Another possible exit is to exchange your interest in a property for a monetarily equivalent ownership interest in a publicly traded company. If this transaction is structured properly you will not recognize capital gains on the transaction until you sell the stock in the publicly traded company. However, to achieve such deferral of capital gains will require rather complex structuring. Generally, you receive dividend and voting rights equal to your pro rata share of the company. Such a transaction allows you to access a larger, more diversified pool of assets and makes your interest more liquid. A drawback of the strategy is that you will have to give up control of the property and will most likely lose the property management fees that you previously earned.

An alternative to selling to a public company is to go public. In order to do so, you would need a large portfolio of diversified assets in a particular property type. The portfolio would also need to have relatively low leverage, predictable cash flows, and institutional reporting. An IPO takes 12 to 18 months and will cost up to 10% of the total amount of capital raised. Additionally, you will incur $500,000 to $1 million in fees regardless of whether the IPO is successful.

Determining an exit strategy is critical. The optimal strategy will ultimately depend on your goals as an investor. Two people looking at the same sales options may make two entirely different decisions based on their objectives.

Questions

These are the types of questions you’ll be able to answer after studying the full chapter.

1. What are the costs associated with selling a property?

2. You acquired a building for $100MM and financed the acquisition with a $75MM interest-only loan. Three years later, you sold the property for $120MM. Assume 70% of the property was attributed to structure and that the structure was depreciated over a 39-year period. Also assume that capital gains are taxed at 15% and that accumulated depreciation is taxed at 25%. Also assume a 3% sales cost for the building and no prepayment penalty for the loan. What would be your net profits?

3. Why may a refinancing be preferable to an outright sale?

4. What is a like-kind exchange (1031 exchange) and why may it be preferable to an outright sale?

5. Assume you want to sell an asset worth $200MM with a $100MM mortgage in place and have identified a $200MM U.S. Government-leased office building to acquire via a like-kind exchange. Assuming that you can finance 70% loan-to-value in the U.S. Government building, how much capital will you realize today? Assume a 3% sales cost and a 1% loan fee on the new financing.

Audio Interviews

Owner exit strategies (5:46)

BRUCE KIRSCH: When we talk about exit strategies, we’re really talking about investing in general. And when people talk about investing, they say you should never go into an investment without understanding upfront how you could potentially exit it. And so this naturally applies for real estate as well.

But when people talk about this notion of exiting, what exactly do they mean? Does it only mean to completely sever all of your financial and legal ties to a property? Or does it also sometimes mean simply recouping your original equity and making some profit on top of that and potentially maintaining some ownership stake going forward?

PETER LINNEMAN: Yeah I think when people use the word exit, they certainly include getting completely out of the property in every way, shape, and form or out of the investment in every way, shape, and form. But they also include partially doing so. How do I get my money back? How do I get my money back and some of my profit? How do I get out if I want to get out? And if I want to get out of it completely, how do I get out of it completely? It’s that whole set.

So it is not just sale. If you think of the thing most students are probably most familiar with is owning maybe I go buy a million dollars in stock in a company, well, what’s your likely exit strategy if you own a million dollars of stock in a company that has a market cap of $5 billion? Well, the likely exit is I sell some or all of my shares when I decide to do so.

And I may not get the price I want. I may get better than the price I thought I’d get. But that’s what I can do with a public company is sell all or part of my shares when I want. As you go away from public companies, and in fact, even with small, illiquid public companies, you have to consider other alternatives than just this nice, little sale of the paper.

If I own a property, it may take me a while to put together a sales document, get the contracts and the leases together for people to evaluate. They’re going to do due diligence. It’s going to take a while to get everything worked out. I have to negotiate. Meanwhile, things can go wrong. They take time.

Also, even to get a loan, I suppose I’m going to get a loan to partially take some or all of my money out of the property, it takes time to negotiate a loan and get the documents done to get a loan and so forth.

So my exit strategy is really saying, look, I don’t know really when I’m going to want my money or how much I’ll get. But at least you force yourself to go through the mental discipline of if I were to sell this, who’s going to buy it? Will they buy all of it? Will they buy part of it? What kind of pricing will they give me? Could I borrow against it to provide some liquidity? Could I borrow more than I have invested?

It’s those kinds of questions. So when you talk about exit strategy, you’re talking about you start that even before you buy it. It’s part of your due diligence, and then it’s an ongoing matter as you manage the asset.

BRUCE KIRSCH: One thing that might not be visually apparent to folks but I think is quite common is let’s say in an urban environment, the prototype is to have a building with the primary use above. And at grade, you have retail and below grade potentially income-producing parking. And so what typically happens for a sophisticated owner or sophisticated developer is when they set up the legal status of that project, they will, in fact, set up a condominium regime that will carve out the parking separate from the rest of the building and carve out the retail separate from the rest of the building. And in so doing, they create this tremendous option value for themselves and different ways to exit or perhaps not exit the property as a whole.

PETER LINNEMAN: To that point, the ideal buyer for an urban parking lot may not be the same as the ideal buyer for, say, Fifth Avenue retail. And it may not be the same ideal buyer as for office building space above. You can imagine a parking company that specializes in owning and operating parking might want the parking component, be the highest value bidder, while a retail company might be the highest value bidder for the retail piece and an office party for the office.

And so if you start out saying, gee, as my exit strategy, am I better off cutting this up into three ownership slices, which the way entails some legal work and some costs associated with that and some brain damage, or am I better off to leave it all together as one? And you have to make those kind of business decisions. Do you really think that the buyers that are out there are going to value it a lot differently? If you think they’re going to value each of those components a lot differently, then you break them up. If you think they value them about the same, save the legal brain damage.

But that’s part of exit strategy. You have to anticipate, and you have to have a view. You’re not always right in your view. But you have to have a view and, like any part of business, adopt strategies and implement strategies that you think will generate the best return.

The origins of the 1031 Exchange (5:01)

BRUCE KIRSCH: A 1031 exchange is a specialized type of exit strategy which was created by the Internal Revenue Service wherein one property is exchanged for another. And the capital gains taxes that would have to be paid on a sale of the initial property are in fact deferred until the sale of the second property. What was the impetus behind this relatively complicated option for exit strategies by the IRS?

PETER LINNEMAN: Like many things, it didn’t start from where it ended up. It started from a very simple that when companies merged I would, quote, “buy your company,” but I pay you by simply giving you a whole bunch of my stock or my partnership interests. So yes, you may have gotten a gain, but you didn’t have any cash. You just had paper that said acquiring company on it instead of the name of your old company on it.

And so people said, gee, when there’s a merger, and I don’t get any cash, I shouldn’t have to pay the capital gains tax until I actually get the cash because all I did was exchange my property for something– my company, my interest, for something just like I got. And I don’t have cash. Cash was not like what I had. And when I get cash, I’ll pay my tax.

And Congress said, yeah, that makes sense to us. And they implemented legislation really geared toward stock companies doing mergers. And then people started saying, wait, wait, wait. Well, what about us? If I exchange in our case property for property, I don’t have cash. All I did was change the name on the paper from building A to building B. And only when I get cash should I then really have to pay a tax.

And Congress said, well, we never thought about that. And you can imagine there was a lot of lobbying, and then they said, OK, but you got to make sure you end up with a like. So if you own your property in partnership, you got to end up with partnership units. Because if you exchanged your partnership units for shares, maybe the shares are more liquid and therefore easier and more valuable. That’s not a like to like.

And the rules and the nuances then begin to proliferate on this relatively simple idea that says until you get cash, you don’t pay a capital gain. But the actual law then becomes incredibly complex and nuanced. And what’s really happened in real estate and in other areas is that very rarely do I say, Bruce, you give me your property. And I’ll give you mine. And it’s a true exchange. It’s very rare that.

More typically, what happens is it says, I’m going to sell my building. But give me a few days. And I’m going to roll that money right into another property that’s pretty much like it in terms of its illiquidity and its risk and its value. And therefore, wait a minute. Since all I did was exchange one asset for another, yes, there may have been cash in between for a few days. But that was just kind of a coincidence.

Most like-kind exchanges in real estate actually involve cash but in this temporary sense in a highly legislated and regulated sense where if you don’t want to pay taxes, it’s highly nuanced as yes, that can’t be cash very long, and you have to turn it back into an ownership position that’s fairly similar to what you had before you sold and got cash. Confusing, complex, and expensive all designed to postpone paying capital gains taxes, particularly if you’ve taken a lot of depreciation over the years. That’s always bothersome because I could be selling a property even at a loss in some cases.

But if I’ve taken enough depreciation, I could have a capital gain due. And people say, wait, wait, wait, I didn’t make any money. I don’t want to pay capital gains taxes. I’ll do a tax-deferred exchange. A lot of times, people end up giving up the value of not paying taxes by paying more for the property because they’re under tight timelines. And it’s not so easy to be done, but it is doable.

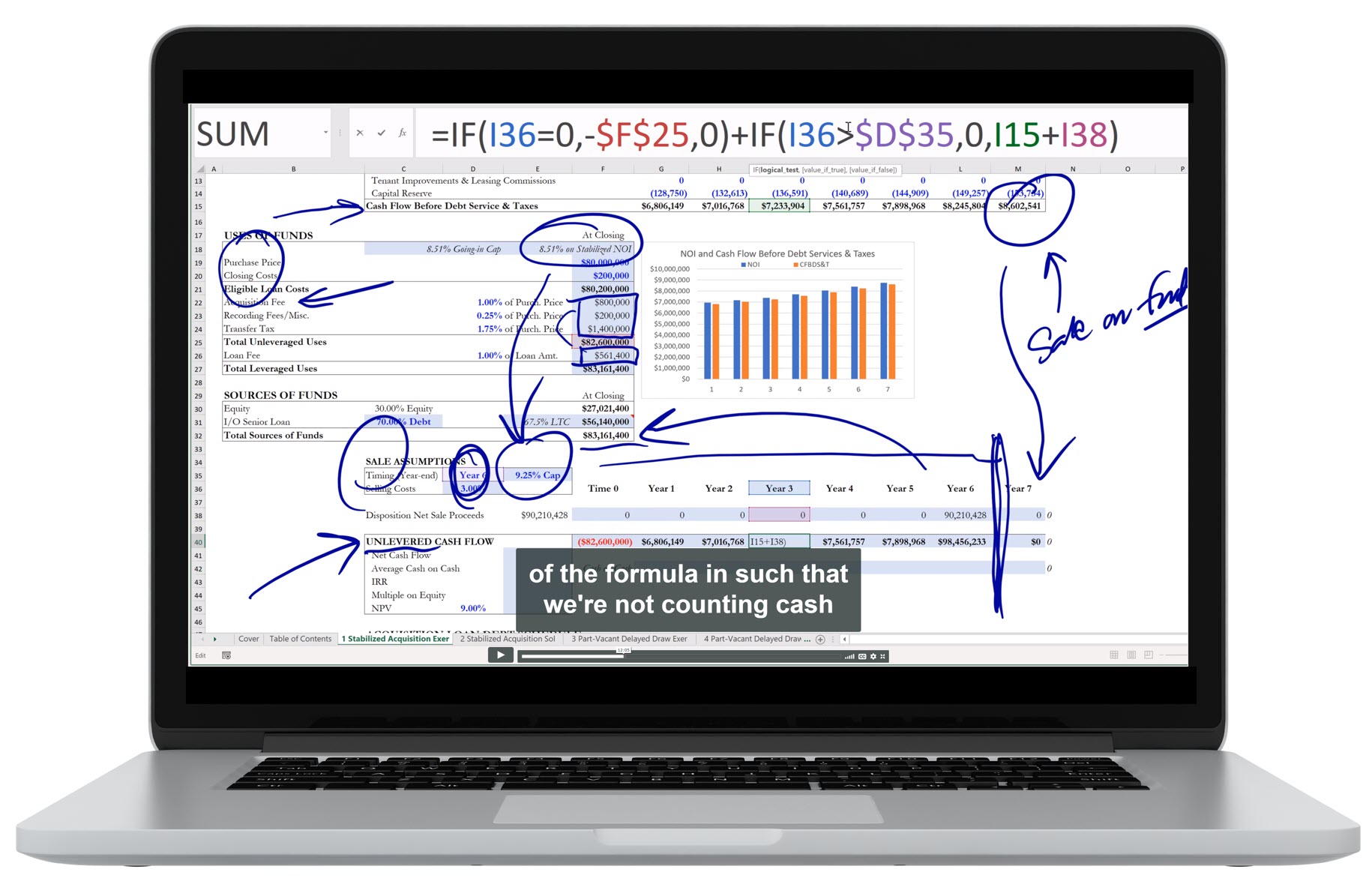

Excel Figures

Key Terms

To view the definition, click or press on the term. Repeat to hide the definition.

Transfer of title of a property from seller to buyer for monetary consideration to seller.

The negotiated property sale price before any potential deductions.

U.S. tax on long-term gains on capital assets. There are two components which are taxed: 1) the actual gain you achieve on the building; 2) the property’s accumulated depreciation.

The amount of a property’s depreciable cost that has been allocated to depreciation expense since the time the property was acquired.

An investor’s net equity position after selling a property and repaying the loan, paying all fees, and paying the IRS.

The replacement of one debt facility with another.

Ownership of less than 50% of a property’s equity, providing no voting impact and an illiquid position.

A legal process codified in IRS section 1031 through which you sell your property free of state and federal income taxes if you purchase a “similar” property within a prescribed period of time, hence forestalling capital gains taxes until you ultimately break the ownership chain.

An independent specialist who executes a 1031 exchange and helps sell the property.

Chapter Headings

- Why Exit?

- How to Exit

- Disposition

- Refinancing

- Like-Kind Exchange (1031 Exchange)

- Exchange for Public Company Shares

- Go Public