Overview

For real estate companies, the aggregate corporate pro forma will generally differ from the sum of property-level cash flows. The value of a real estate company can be greater or less than the value of its properties, as management can both add and destroy value beyond that of the properties.

Summary

Listen to this narration if you prefer

The most significant differences between property- and company-level projections are: company-level overhead (at the property level, there is no line item for corporate general and administrative expense); corporate level debt (there may be debt not secured by real estate); income derived from non-real estate assets (e.g., from stocks, bonds, etc.); license fees (e.g., licensing of your company name for merchandising); and management fees, development fees, or leasing commissions from your properties or third party properties you may service.

It is important to note that Wall Street analysts do not roll up property-level pro formas to determine corporate values. This is because analysts are typically not privy to such detailed private property information. As a result, Wall Street analysts provide workable but imprecise financial descriptions of companies.

The following are key assumptions used in producing a company financial pro forma: acquisitions and developments and their income rates of return, dispositions, and revenue growth on existing properties. These assumptions allow for modeling of aggregate property NOI. Layering in corporate fees from noncombined affiliates, interest income and deducting G&A, we can calculate corporate EBITDA (earnings before interest expense, taxes, depreciation and amortization).

Funds from Operations (FFO) refer to funds available to equity. Specifically, FFO equals NOI plus other income, minus overhead and interest payments but before depreciation, amortization and tax considerations. FFO does not include cap ex, tenant improvements and leasing commissions. So while two companies may have the same FFO, they may have very different free cash flows. Adjusted FFO (AFFO) is FFO less estimated recurring cap ex, leasing commissions, and TIs. AFFO is also known as Funds available for distribution (FAD).

A DCF valuation of a real estate company values the company’s ability to generate recurring cash streams. This is no different from valuing any company. To obtain the equity value of the company, one must deduct the value of liabilities. Another method used is the cap rate approach, wherein a single cap rate is applied to the NOI roll-up of all properties.

Net Asset Value (NAV) is a common third approach to valuing a real estate company. The NAV method assumes that corporate management adds no value. The total value of a real estate company should include: the aggregate capitalized value of the properties, the property management business, the development business, and the land held, plus the company’s cash position. To reach the NAV, subtract the value of the company’s debt and other liabilities. It is important to note that NAV fails to reflect hidden tax, debt, and environmental liabilities. For example, prepayment penalties associated with debt are not deducted but are an important liability.

In the end, what makes a property company potentially more valuable than the value of its properties is people. The people who work for real estate companies should be able to execute value-enhancing transactions on a consistent going-forward basis.

Questions

These are the types of questions you’ll be able to answer after studying the full chapter.

1. Why can the value of a real estate company be greater or less than simply the value of its properties?

2. What are the primary ways management can add value beyond the properties?

3. What is FFO and what does it include and not include?

4. Why are management agreement cash flows usually ascribed lower multiples than property cash flows?

5. Calculate the equity value for the following company. EBITDA in year 1 is expected to be $100M and is expected to grow by 1% for each of the next 5 years. Cap Ex, TIs and LCs are expected to be $7M in year 1 and are expected to grow at 3% for each of the next 5 years. Currently the company has $500M in debt and this is expected to remain constant going forward. Assuming an exit in year 6, what is the equity value of the company today? Assume a 10% discount rate and an 8% cap rate.

Audio Interviews

The challenge of valuing real estate companies (4:31)

BRUCE KIRSCH: In chapter 12, we look at real estate companies. We’re looking at everything up until this point at the individual property level, individual asset level. And for people who love being close to the property, this has been interesting stuff.

For people who don’t love corporate finance, this is the point of transition where suddenly we’re not talking about a property so much anymore. We’re talking about a company. Now we’re talking about gap. For some people, their eyes start to glaze over, mine in particular. I love talking about property level stuff.

So that said, this is how the business works. And as people scale businesses, they form property operating companies and development companies. And so the question is, is the company worth more than the sum of its parts?

It can be, or it can be worth less. And you give the example of English companies based in the UK, where they’re taking safe cash flow stream and essentially destroying some value by putting those safe cash flows into risky developments. That said, we need to put a value on a company. So what are the main challenges in valuing a real estate company?

PETER LINNEMAN: Well, interestingly, you were talking about your background in the property side. I came the other way. I had spent the first 15 years or so of mine not in real estate, but in companies– bank companies, manufacturing companies and so forth. So for me it was the reverse. I found it, quote, “relatively easy” to think about companies, and relatively hard to think about the asset.

Let’s face it. The hardest thing to figure out about a company is its future prospects beyond its current assets. And you can basically state that is the value of management. The– I’ve got– I’ve got the assets. This is no different for real estate, anything else. I’ve got the physical. I’ve got a factory. I’ve got whatever, trucks and so forth. Well, in real estate I have buildings. But I think there’s value beyond that.

You think there’s value at Amazon beyond their warehouses and their systems, because you believe they’re going to continue to grow because management is going to come up with new ideas that are profitable. The challenge in real estate is it’s very capital-intensive and less idea-intensive. So the value creation of management, even really great management, is small compared to the assets you have to deploy to do it.

And that’s always been the frustration, which is management can add value. And it’s great, but the extra value of management’s small because the demand of the capital is so large. I see I need to have a building there. That’s a great idea. It’s a value adding idea. But now, I need $600 million to just build the building.

So the hard part is, what is management worth? And there are periods where you look at it and you might say, I think the assets are worth more than the company. You say, well, why don’t I sell it? And you go, well, because I think management’s an asset.

The flip of that is, well, maybe the reason it looks like the parts are worth more than the whole is because I haven’t correctly analyzed the parts. And in fact, the whole may be worth more, and I’m overestimating the value of the parts. And I’ll not know it until I would be to try to harvest it.

And so the frustration is you believe you can look to the assets for comfort. But there’s enough variability in your estimate as a very great professional of what, 5% on the value? And management may only add 3% or 4% or 5%. So the margin that value add is of management is around the magnitude of your “I could be wrong on my asset values,” and it makes it harder.

Whereas, if you’re in a– if you’re– and taking an extreme case, if you look at Amazon, the only thing people are betting on is management. They’re not betting on their assets. They’re betting on the management. So by the way, they could be wrong about the value of the assets, but that’s small compared to what they believe management can add. That’s the challenge. It’s what I find makes it fun, though.

A potential pitfall for new real estate companies (2:01)

The risk/reward trade-off of cross-collateralization (1:38)

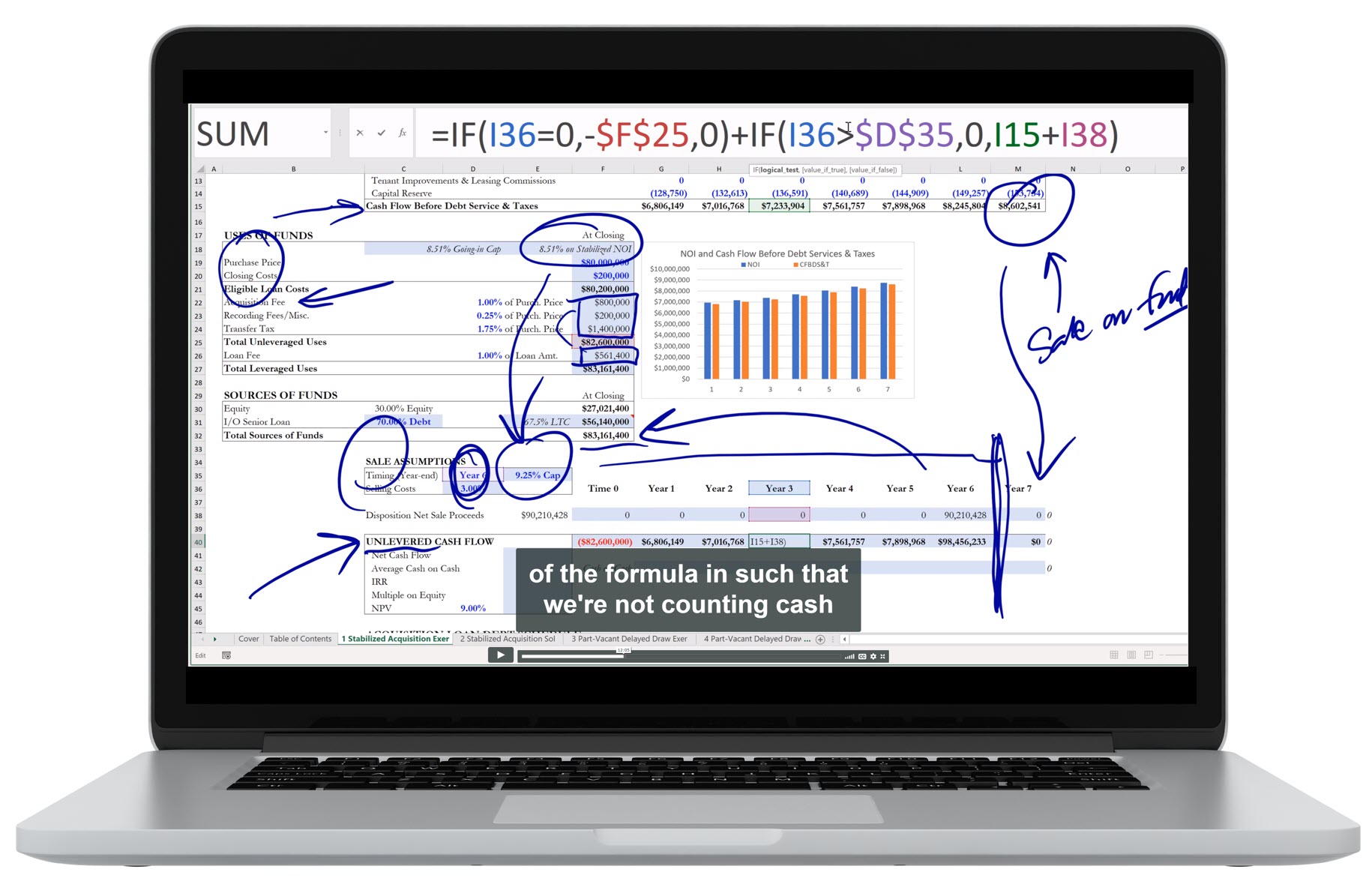

Excel Figures

Key Terms

To view the definition, click or press on the term. Repeat to hide the definition.

Corporate overhead expense related to the day-to-day operations of the company as opposed to the properties it owns.

A company’s earnings before interest, tax, depreciation, and amortization; calculated as Property NOI plus noncombined affiliate fee income, plus interest income from non-real estate assets such as bonds, minus company-level G&A expenses.

Funds from core operations available to equity owners on a pre-income tax basis.

A real estate company’s cash available for distribution to shareholders without a deterioration of its asset base.

A commonly-used approach to valuing a real estate company that assumes that management neither adds nor subtracts value.

Chapter Headings

- Differences Between Property- and Company-Level Cash Flows

- Company-Level Net Income Projection

- Existing Properties Revenue Growth

- Acquisitions and Developments and Rates of Return

- Dispositions During the Period

- Fees from Noncombined Affiliates

- EBITDA

- Debt Service Expense

- Amortization and Depreciation and Impairments

- Minority Interest

- Value of a Company

- Funds from Operations

- Adjusted Funds from Operations

- DCF Valuation

- Cap Rate Valuation

- Net Asset Value