Overview

Real estate developers and operators are in the business of servicing demand from population and job growth for places to live, work, play, and shop. From 2017 to 2030, the U.S. is poised to grow its population by some 33 million people, due in part to continued strong immigration. However, there is no such thing as a homogenous “national” real estate market – the dynamics of individual sub-markets are unique, and growth does not occur uniformly from place to place. Responsible analysis of a sub-market involves its study from the bottom up, rather than a top-down interpolation from national trends.

Summary

Listen to this narration if you prefer

Population and job growth fills space and supports new development, thus it is of high interest to financial stakeholders in real estate. Vigilant commercial real estate stakeholders are constantly refining their theses for demand for their real estate products, focusing on the most local levels possible.

Two studies in particular provide insights into past and future U.S. metropolitan area population and job growth. The first forecasts Metropolitan Statistical Area (MSA) growth as a percent of the total U.S. population, determined by local factors such as: share of foreign-born residents, educational attainment, race and age share percentages, taxes per capita, voting trends, political party representation, weather characteristics, age of housing stock, proximity to an ocean or Great Lake, and geographic region. These dependent variables capture attributes of an area that cause it to grow economically and attract employers and employees.

This 2006 Peter Linneman and Albert Saiz regression analysis-based study, updated by Linneman Associates in 2014, found that about 75% of all variation in county population growth is statistically identifiable. In other words, there will always be “wild card” factors that cannot be foreseen, such as where Sam Walton decided to locate Walmart’s operations, or where Amazon selects for its second headquarters. The analysis reveals that the single most important factor in determining future population growth is past growth (a conclusion confirmed by prior studies). Other significant predictors included economic diversity, immigrant presence, a skilled labor force, weather, and the vintage of the existing housing stock.

Generally, population and job growth occurs where: people want to live and play; necessary building approvals are relatively easy to obtain; potential growth can be accommodated; and firms find it efficient to produce. The latter relates to the notion of agglomeration economy benefits – that is, firms becoming more productive if they locate closer to similar firms, enabling them to share information, infrastructures, and a pool of relevant workers, and to reduce the transportation costs of their common inputs and outputs.

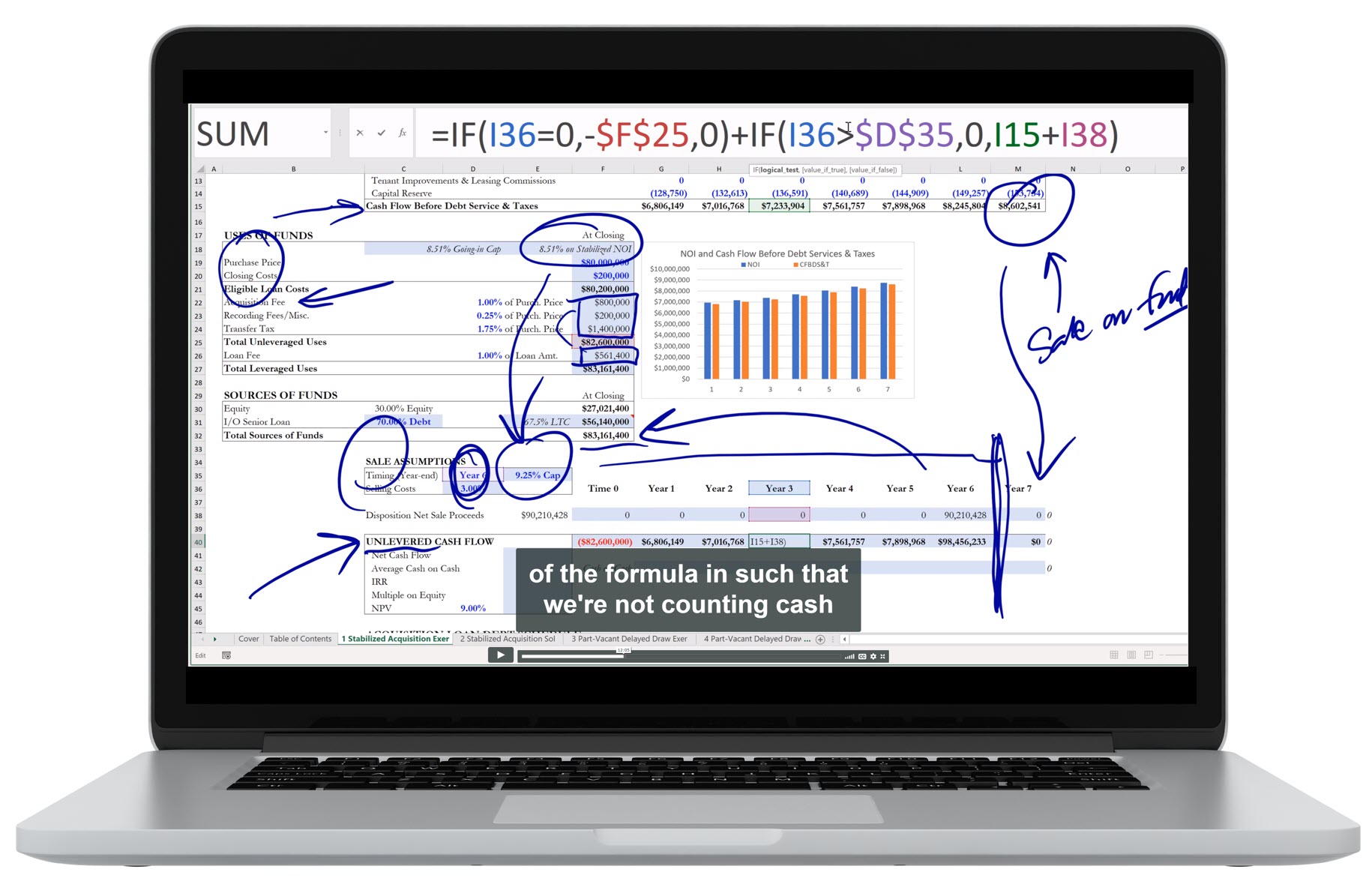

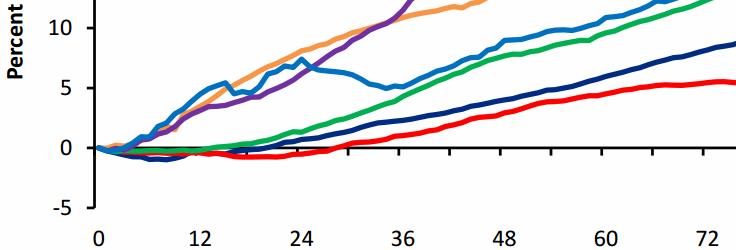

The second study, performed by Linneman Associates, attempted to answer the question: as the U.S. economy moves through cycles, which MSAs will over-react around trend growth on the up-cycle (but disproportionately suffer during down-cycles), and which will under-react, growing more steadily around their trends over the cycle? The analysis provides a metric with which to manage risk expectations around generally smoothly growing pro forma analyses of local demographics.

The models produced by the study are simple indicators of how coincident each MSA’s economy is with movements of the national economy, providing insight into the demand volatility around the local trend during unusual boom or bust times (which occur, but are never modeled in pro formas).

The interaction between an MSA’s intrinsic growth (its “alpha”) and its “beta” (a multiplier applied to the national percent change in employment) is summarized by the U.S. employment growth rate required to generate positive job growth in the MSA. Specifically, what minimum employment growth rate at the national level is associated with positive job growth for each MSA? The more negative this “breakeven” U.S. job growth rate, the stronger are the MSA’s underlying growth fundamentals. The study found that the most predictable MSAs with respect to coincident job growth when there is national job growth are Chicago, Charlotte, Atlanta, Cleveland, and Minneapolis, while the least predictable are Honolulu (by far), Knoxville, Albany, D.C., and Houston.

These analyses have important consequences for investors. Specifically, when the national economy is in a strong expansion phase, targeting office development in high employment beta MSAs provides the greatest space-demand upside. When national employment grows, Fort Lauderdale, West Palm Beach, Detroit, Austin, and Boston exhibit the highest employment growth betas and, thus, will experience the greatest regional percentage growth above that of the nation. During a national recession, on the other hand, low employment beta MSAs, such as New York, Philadelphia, Houston, St. Louis, and Washington, D.C., provide greater downside demand-risk protection.

Questions

These are the types of questions you will be able to answer after studying the full chapter.

1. What did the 2006 Linneman/Saiz study conclude was the number one predictor of future metropolitan area growth? What are other significant predictors?

2. What are agglomeration economy benefits?

3. Why should real estate investors care about the extent to which a particular MSA’s employment growth moves on a muted or magnified basis relative to national employment growth?

Audio Interviews

A Nation of Constant Positive Population Growth (2:45)

BRUCE KIRSCH: We open up the chapter saying, the US is a nation of constant, positive, population growth, and that’s one of the great things about this country. Why is it that the US finds itself in this fortunate state, but some countries in Europe are net negative on population growth?

DR. PETER LINNEMAN: Well, the extreme case would be Japan, which is actually shrinking, notably, in population, and China, which is about to go completely flat. Look, I think it’s pretty simple, the dynamics of population growth and why the US grows. First and foremost, we have been a nation of immigrants, and we’ve been a nation that is relatively good at integrating immigrants. I’m not saying we’re great at it, I’m saying relative to other countries. Immigrants, certainly within two or three generations, are well assimilated, by and large, into our economy. It may be difficult for the first generation, because of language, and so forth, but we’re very good at it. And as a result, we get, roughly, about half of our population growth from we’re good at immigration, and so people want to come here- and we’re a good economy with a good framework, and so forth. And we just are much more open, and good, and better at integrating immigrants than pretty much most countries in the world.

The second is, our birth rate is higher than in places in Europe and Japan, where the birth rates are sort of 1.2, 1.1, 1.3 births for each birth age woman. And you go, well, they may be replacing themselves, but they’re only replacing 2/10 of their husband. We’re still right around two, so each birth-age woman does about two. That’s highly skewed, interestingly, with immigrants, and the children of immigrants being a bit higher than two- and those who have been here longer than a generation or two being lower than two, not quite European or Japanese in that regard.

And the last part is as medical technology improves, we live longer, and that’s not differentially true here than Europe or Japan, right. But it’s you get fewer people dying, they live five years longer, you get population growth. But the big two are really we have higher birth rates, particularly among immigrant generations, and we have a much more open society at integrating immigrants. I wish it were better than we are, but that’s basically what it is.

Technological Impact on Agglomeration Benefits (2:36)

BRUCE KIRSCH: In the beginning of the chapter, we mention a key term, which is agglomeration economies. And this basically says that the reason that dense urban areas exist is because, well, we’re social animals. And we trade with one another, and we work together, and it’s beneficial, more so than it is to not be near one another.

When broadband started to really penetrate the US, and it’s obviously penetrated the whole world, and now we have very, very inexpensive robotics, in your mind– and I know this is looking sort of the way down the road, but in your mind, do you think that continued significant broadband penetration and telepresence or holograms or anything of that nature is going to move the needle on whether agglomeration economies and density are still important?

PETER LINNEMAN: I don’t think it changes it much. You look at Seattle area, which by historic standards, was remote. And it’s been one of the great growth areas, because you have major companies who have spun and grown– Microsoft being obvious. But not only did they grow, they were entrepreneurial. And five of their people left and started their own firms doing related but not the same. And then one of those people left.

And so I think the agglomeration benefit– yeah, we talk about it’s nice to have a whole bunch of other people like me around. And you see some of that. But it’s not like the Chrysler worker walks over to the Ford factory and says, how are we doing? It’s not so much that.

I think where it really comes as an agglomeration tends to be from the top, which is you get the entrepreneurial management type spin-out. And if you’ve got a big agglomeration in an industry or a set of industries, that means more people are spinning out creating new firms. If you don’t have much of an agglomeration, you could have some be successful, but it’s not a big enough success to spin out in people.

And so I think that’s where the agglomeration comes. And there’s not much evidence that the benefit of agglomeration is dissipated as technology has improved. And in fact, if anything, you look at the rebirth of New York City, it would suggest that if anything, agglomerations are more important today than in the past. I’m not sure that’s in spite of or because of technology. But certainly, there’s no evidence of a big change.

Regional Employment Growth Variability (1:57)

BRUCE KIRSCH: You performed a very interesting study on regional growth variability. It looks at different characteristics, and the statistical simulation creates these alpha beta continents. What did you learn from this simulation, and what’s the key takeaway there?

PETER LINNEMAN: It’s interesting. I had looked at, and we describe also in the chapter, the more traditional type of, well let’s see how that area grows depending on education, and let’s see how it grows on the weather, and other things. And then, it occurred to me some years ago. Why don’t we just look at it the same way people look at stock returns? There’s an intrinsic growth dimension.

And there’s a dimension that varies depending on where the US economy is at. Well, the most interesting thing I learned from those studies is, not every place varies with the economy the same way. Some are hyperreactors. And I’ll give you the obvious examples. You think of Orlando. Orlando is a hyperreactor to the US economy. When it’s down, they can forestall my vacation to Disney. When the economy’s great, let’s take our vacation to Disney. And so it’s a hyperreactor.

And then, you look at places like state capitals. And I should have known it, but I hadn’t quite focused on it. You look at places like state capitals, they tend to be not hyperreactors. Because while the private sector may go up and down with the US economy, the state governments are much flatter, much more stable. And so they have relatively low betas if you say reacting to the economy.

And I just think it’s a useful way– it’s not a perfect way– it’s a useful way of thinking about, normally as you know, I hear people say, well, it’s a great growth market. Is it a great growth market because the US economy is booming? Or is it a great growth economy because in and of itself, it grows a lot? And the disentanglement of that, you can see very different patterns for very different places.

Key Term

Agglomeration Economies – the benefits that come when firms and people locate near one another together in cities and industrial clusters.

Chapter Headings

- A Nation of Constant Positive Population Growth

- Metropolitan County Population Growth

- 2030 Forecast

- Local Population Growth Insights

- Past Growth

- Economic Diversity

- Immigrant Presence

- Biology and Age Distribution

- Weather

- Vintage of Existing Housing Stock

- Coastal Adjacency and Zoning

- Educational Achievement

- Local Income and Sales Tax Rates

- Skilled Labor Force

- Population Density

- Regional Growth Variability

- Methodology

- Insights

Learn about REFAI Certification

< Ch 7 | Real Estate Due Diligence Analysis

Ch 9 | The Use and Selection of Cap Rates >

Table of Contents

Index

Buy the Book